Bank Statement API

Managing financial data has become a top priority in today’s digital finance world. Old-school methods of entering this data by hand take a lot of time and can lead to mistakes - that's where bank statement APIs come in.

These tools make it easier to get and organize financial data from bank statements, changing how businesses manage this information. In this guide, we'll look at bank statement APIs, how they work, their benefits, and how businesses and developers can make the most of them.

What Is a Bank Statement API?

A bank statement API is a tool that helps businesses to automatically parse bank statements, extracting important financial data like transaction details, account balances, and customer information without doing it by hand.

It pulls details like transactions, account balances, and customer info. The API uses technology like optical character recognition (OCR) and some smart algorithms to turn those paper statements into easy-to-read digital formats, like converting them from a bank statement to JSON format.

The core benefit? It saves time and cuts down on mistakes, making financial data extraction a lot easier for businesses.

The Growing Role of Bank Statement APIs

With the rise of digital banking and fintech services, getting accurate and timely financial data is more important than ever.

Whether it's for automated bank data imports, preventing fraud, or meeting regulations, businesses need up-to-date financial information to make smart choices.

Bank statement APIs are key for:

- Lending and credit checks

- Meeting regulations (like KYC and AML, which often require officially verified documents, such as a certified bank statement)

- Managing expenses and cash flow

- Automating accounting and bookkeeping

- Underwriting insurance

- Providing financial advisory services

- Conducting corporate finance audits

- Helping with personal finance tools

- Managing investment portfolios

As the financial world changes, the need for quick and smart ways to extract transactions and understand customer financial behavior increases.

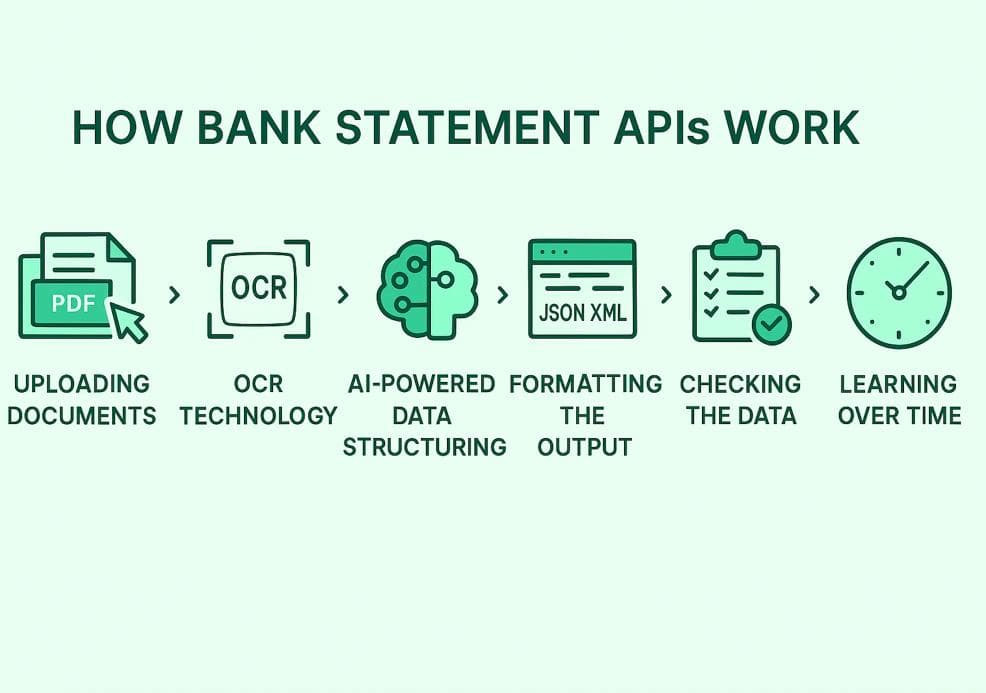

How Bank Statement APIs Work

Bank statement APIs help pull data from your bank statements using some neat tech. Here’s how it all goes down:

1. Uploading Documents

You start by uploading your bank statements. These can be in formats like PDF, images, CSV, or Excel. The API has to deal with a mix of digital and scanned files since banks have different document layouts. With Convertbankstatement for this step, you just click on the “Choose File” button here, which pops up on the main page:

2. OCR Technology

The leading tech in play is Optical Character Recognition, or OCR. This scans the document and turns the text into something a computer can read. Good OCR tools can pick out various fonts, handwritten notes, logos, and tables often seen in bank statements.

3. AI-Powered Data Structuring

Once the OCR gets the text, AI steps in to break down the info into important pieces like:

- Account holder's name and address

- Account number and routing info

- Statement dates

- Opening and closing balances

- Transaction dates

- Descriptions and merchant names

- Debit and credit amounts

- Currencies

- Running balances

- Types of transactions (like utilities, groceries, etc.)

4. Formatting the Output

After that, the data gets organized into formats that computers can easily read, like a bank statement to JSON, XML, or CSV. This makes it super easy to use with other systems.

5. Checking the Data

Many APIs also check the data for any mistakes, duplicates, or missing information to ensure you get reliable financial data.

6. Learning Over Time

Some advanced APIs have models that learn and improve as they handle more statements and data, improving how they pull out the correct information.

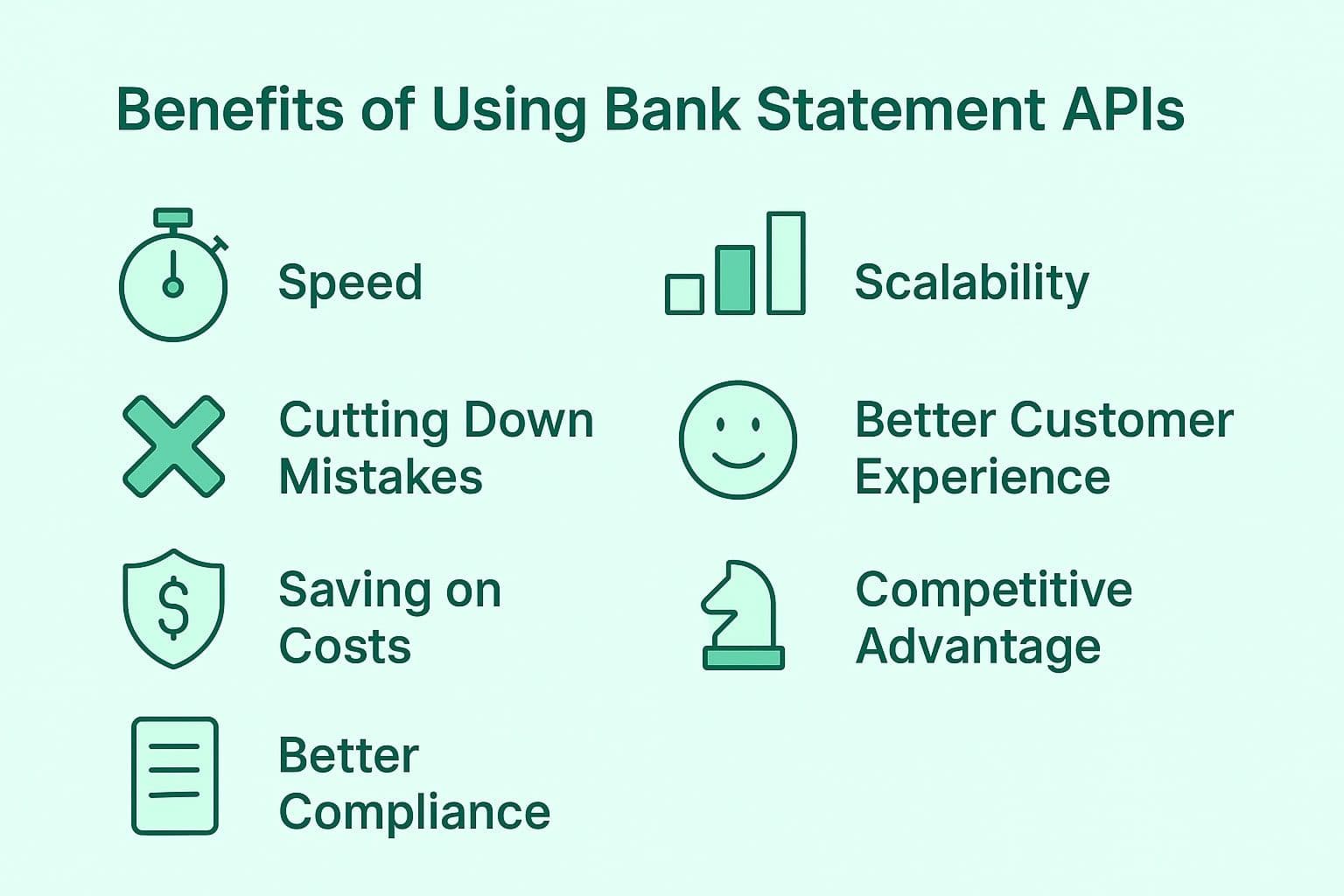

Benefits of Using Bank Statement APIs

Switching from manual to automated financial data handling has a lot of advantages:

1. Speed

Bank statement APIs help businesses pull data in just seconds, cutting down on the long hours or days usually needed to process this information. This real-time data extraction is great for growing companies that need to manage large amounts of documents quickly.

2. Cutting Down Mistakes

With bank statement APIs, there's no need for manual data entry, which means fewer costly errors. These tools can accurately read from many bank statements, so the data stays reliable. Plus, there are log files that track the extraction process, making it easy to check everything later.

3. Saving on Costs

Automation means less time spent on data entry, lowering company costs. By relying less on manual work, businesses can keep their data accurate while freeing up resources for more critical tasks, improving their bottom line.

4. Better Compliance

Getting data right is crucial for following rules, especially for processes like bank statement verification. Bank statement APIs create secure logs and trails that help businesses stick to strict regulations without worry.

5. Scalability

As companies expand, they get more financial data. Bank statement APIs can handle thousands of statements daily without overloading the systems, making it easy for businesses to keep up with rising demands.

6. Better Customer Experience

By speeding up loan approvals and getting financial products set up faster, bank statement APIs make life easier for customers. Features that let users upload documents and get them processed immediately help them finish transactions quickly, leading to quicker decisions and happier customers.

7. Competitive Advantage

Using bank statement APIs gives businesses real-time financial insights faster than their competitors. This quick access allows them to create special product features backed by strong data extraction, keeping them ahead in their industry.

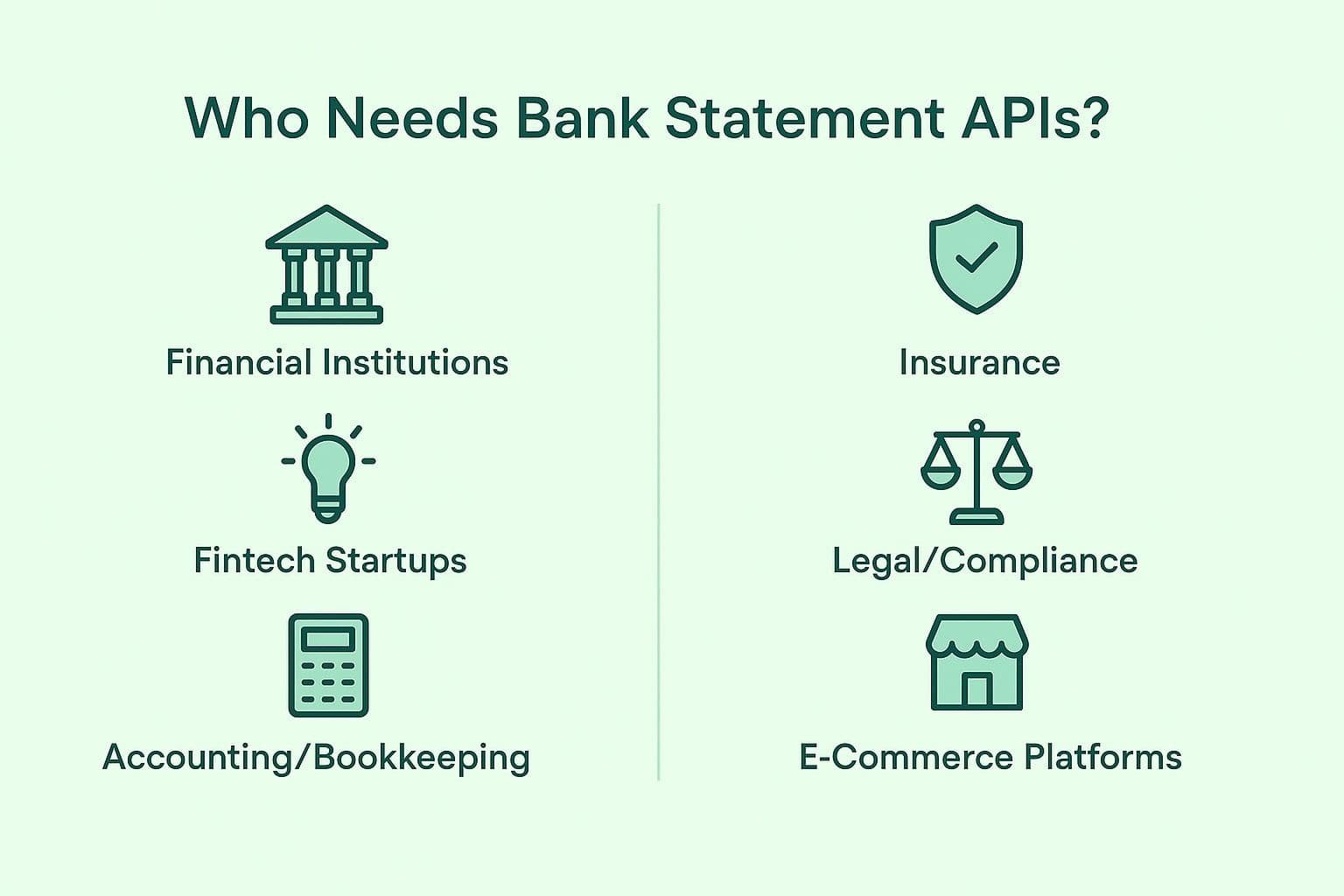

Who Needs Bank Statement APIs?

Bank statement APIs have a lot of uses across different industries:

Financial Institutions

- Verify income for personal loans, mortgages, and credit lines.

- Spot risky financial behavior or strange transactions.

- Look at the cash flow to figure out how much someone can borrow.

- Make the onboarding process smoother for neobank customers.

Fintech Startups

- Boost financial wellness and budgeting apps.

- Create personal finance dashboards to track spending habits.

- Enable quick onboarding with document checks.

- Build AI-driven credit scoring models based on cash flow.

Accounting/Bookkeeping

- Automate importing bank data.

- Reconcile client bank accounts without much manual work especially when combined with tools that support a clean bank reconciliation audit.

- Generate financial statements with little human input.

- Create personal finance dashboards to categorize bank transactions and track spending habits.

- Sort revenue and expenses in real time.

Insurance

- Verify income and financial status for policy approvals.

- Quickly find fake bank statements or fraudulent claims.

- Verify bank activity related to claims.

Legal/Compliance

- Conduct due diligence for mergers and acquisitions.

- Help with Anti-Money Laundering (AML) and Know Your Customer (KYC) processes.

- Provide transaction histories ready for audits.

- Assist in forensic accounting investigations.

E-Commerce Platforms

- Check merchant financials for onboarding.

- Keep an eye on seller transactions to catch potential fraud.

Bank Statement API vs. Open Banking API: What's the Difference?

Bank statement APIs and open banking APIs might look alike, but they do different jobs based on where the data comes from, how they work, and what they're used for.

Data Source

A bank statement API uses files people upload, like PDFs or CSVs. An open banking API hooks right into someone's bank account to grab info in real-time.

Technology

Bank statement APIs use tech to pull data from documents. Open banking APIs directly connect to banks for live data.

Use Case

Bank statement APIs shine when you need old data, great for things like approving loans or checking IDs. Open banking APIs give you real-time info on balances and transactions, so they're awesome for budgeting apps and stuff that pulls all your finances together.

Consent Model

With bank statement APIs, people give consent by uploading a document. Open banking APIs need permission through a secure method, meaning users have to say it's okay for other apps to get into their bank data.

Good For

If you need to check documents or look at past money habits, bank statement APIs are key. If you want data right now, open banking APIs are the way to go, mainly for apps that give you live updates on your finances.

Why Use Convertbankstatement.io for Bank Statement Parsing

Automating the extraction of bank data can save a lot of time and cut down on mistakes. For fintech teams, accountants, and developers who need to import transactions, having a simple and reliable tool is a must.

Convertbankstatement.io is designed specifically for this purpose. It takes complicated PDFs and turns them into clear, organized data using the same intelligent technology that powers our bank statement extraction software. It works with many types of bank formats, processes quickly, and doesn’t need any technical setup or coding. If you often deal with financial documents, it’s a user-friendly, affordable way to keep your data flowing smoothly.

Whether you’re creating apps, checking finances, or sorting through bank transactions, Convertbankstatement.io helps you get the right results quickly.

Key Features to Look for When Choosing a Bank Statement API

Choosing the right bank statement API is a big deal. Here’s a handy list to help you out:

1. Parsing Accuracy: Can it accurately grab transactions and important financial info?

2. Template Flexibility: Does it work with different bank formats and layouts from around the world?

3. Security Standards: Look for encryption and compliance.

4. Output Formats: Make sure it can convert bank statements to JSON, CSV, XML, and Excel.

5. Developer Tools: Check for easy-to-understand documentation, SDKs, and a testing environment.

6. Integration Speed: Needs to support REST API and have low-code or no-code options.

7. Reliability: Look for at least 99.99% uptime and scalable cloud options.

8. Support: Good customer service and ongoing tech support are a must.

9. Customization: It should let you create custom models for unique bank templates.

10. Cost Structure: Make sure the pricing is clear and can grow with your business.

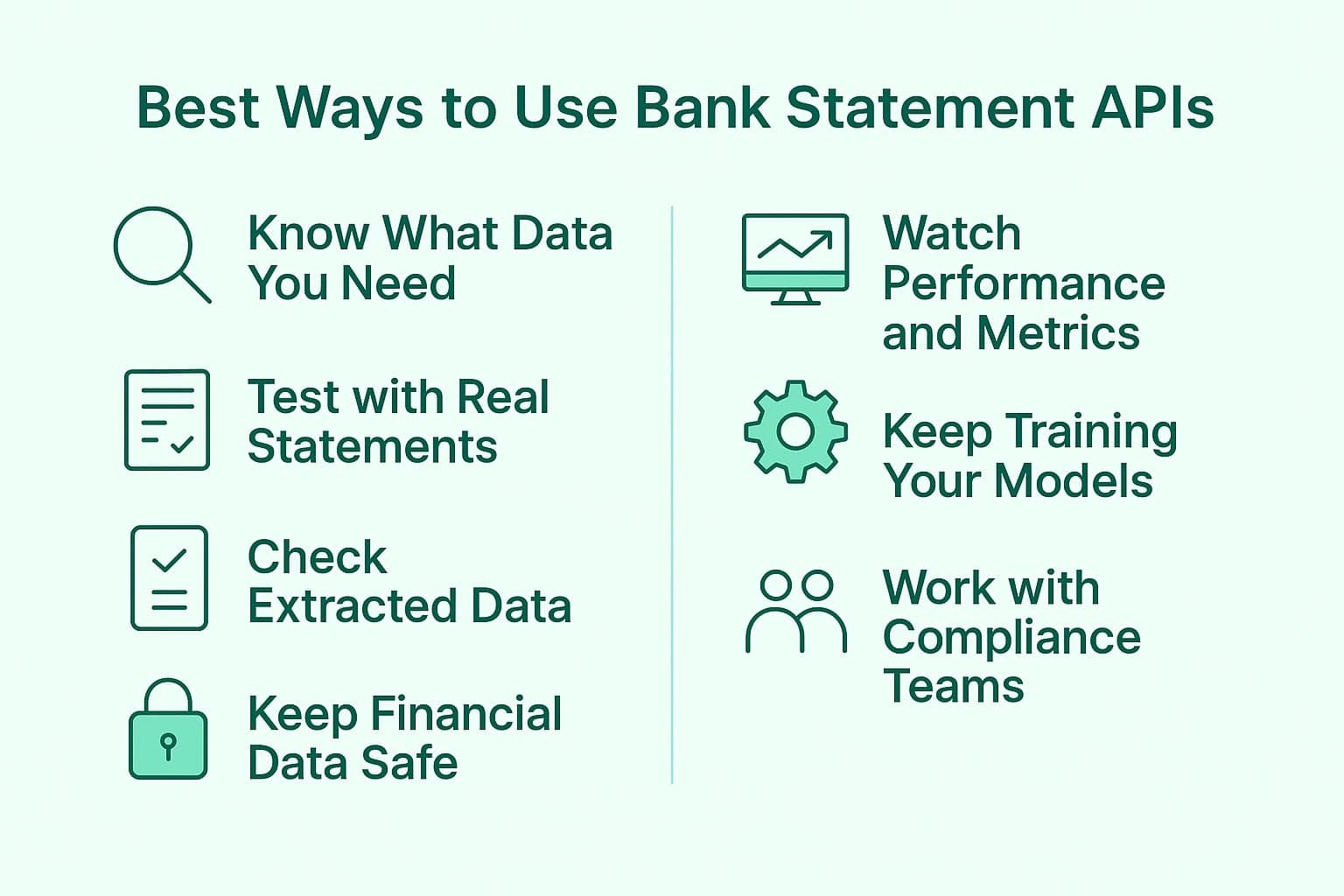

Best Ways to Use Bank Statement APIs

To make integration smooth and get the most out of it, here are some tips:

1. Know What Data You Need

Figure out the important data fields you need, like transactions, balances, overdraft fees, and currency conversions.

2. Test with Real Statements

Try using different real bank statements to see how well the system works across different formats, banks, areas, and languages.

3. Check Extracted Data

Regularly cross-check the data you pull out to catch any mistakes, especially for anything that’s required by law.

4. Keep Financial Data Safe

Make sure to use role-based access, have a clear data retention policy, store tokens safely, and encrypt all transmissions.

5. Watch Performance and Metrics

Create dashboards to keep tabs on how fast data is extracted, how quick the API responds, error rates, and how many documents fail.

6. Keep Training Your Models

Use APIs that let you fine-tune models for your specific documents so they get better at accuracy over time.

7. Work with Compliance Teams

Team up with your legal and compliance teams to make sure you’re following all the rules and guidelines for data handling.

Conclusion

Bank statement APIs represent a powerful technology revolutionizing how financial data is handled. They help businesses automatically read bank statements, cutting down on the need for manual entry and improving accuracy. Whether you're a lender, a fintech startup, or a financial institution, using bank statement APIs can really boost how you handle data.

And for developers seeking to deploy macOS-based OCR for bank statements solutions, Convertbankstatement.io provides a lightweight solution designed for quick document conversion.

FAQs

1. What’s a bank statement API used for?

A bank statement API helps automate getting financial info from bank statements. It makes it easier for businesses to look at transactions, check income, help with lending, and keep up with KYC and other regulations.

2. How does OCR work for bank statements?

OCR, or Optical Character Recognition, scans both printed and handwritten bank statements, turning them into data a computer can read. It picks out important details like dates, amounts, and descriptions for further use.

3. Can bank statement APIs work with different bank formats?

Yes, many advanced bank statement APIs can handle various bank formats, layouts, languages, and currencies thanks to AI and machine learning, which makes them adaptable for different countries.

4. Is a bank statement API safe to use?

Good providers use encryption and other security measures to keep financial data safe while it’s being processed, stored, or sent.

5. What’s the difference between bank statement APIs and open banking APIs?

Bank statement APIs get data from uploaded documents, while open banking APIs access live transaction data from bank accounts that customers have allowed them to access.

6. Can small businesses make use of bank statement APIs?

Definitely! Small businesses can use these APIs to automate their bookkeeping, verify transactions, speed up customer onboarding, and make financial reporting easier without doing it all by hand.