OCR Bank Statement: Save Time, Reduce Errors

OCR Bank Statement is one of the fastest and most accurate ways to process documents for business in the digital age.

Bank statements hold sensitive financial information, and manual extraction of this data is prone to errors and is time-consuming. This is where OCR bank statement extraction comes into use, using some advanced forms of technology to automate and optimize the entire process.

What is an OCR Bank Statement?

A bank statement OCR is the result of using Optical Character Recognition (OCR) to extract data from a scanned or image-based bank statement file. It transforms text, numbers, and tables into searchable and editable data, enabling fast, accurate, and automated financial processing.

OCR recognizes characters, numbers, and tables and drastically eases financial document processing, permitting it to be fast, accurate, and scalable for large-scale volumes of documents.

Using smart text recognition and AI, OCR can accurately grab important info like:

- Transaction dates, amounts, and descriptions

- Account numbers and balances

- Statement periods and summaries

This way, you don’t have to manually enter data anymore, which speeds up how you handle finances and provides reliable data that can be used for accounting, compliance, and other purposes.

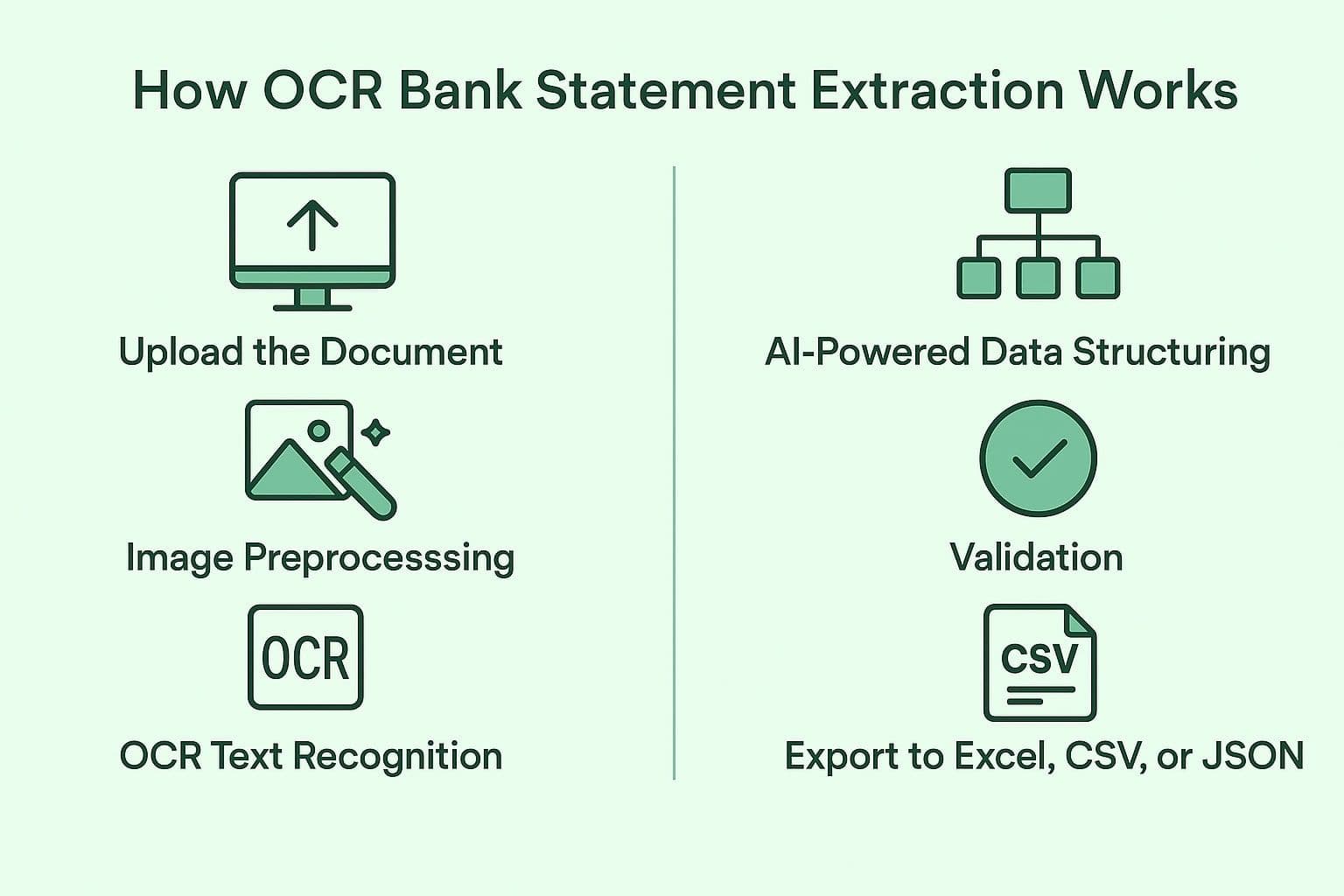

How OCR Bank Statement Extraction Works, Step-by-Step

An OCR bank statement extractor leverages OCR tools with AI and machine learning to convert scanned bank statements into structured data that can be used immediately. Let us go through a simplified description:

Upload the Document

Start by uploading your scanned PDFs / digital bank statements.

Image Preprocessing

Before getting into the extraction, the document is automatically cleaned up to make sure the OCR works well:

- Fixing any tilted pages

- Removing any smudges or background noise

- Adjusting the brightness and contrast

- Correcting any wrong rotations

- Improving low-quality scans

These steps help in recognizing the text better, especially if the scans aren't perfect.

OCR Text Recognition

The OCR engine checks out the document and converts the printed text into data the computer can read. It pulls out important details like:

- The account holder’s name and address

- Account numbers and bank details

- Statement periods

- Opening and closing balances

- Individual transactions (dates, descriptions, amounts, and currencies)

AI-Powered Data Structuring

Once the data is extracted, AI helps organize it into clear fields:

- Dates of transactions

- Descriptions of payments

- Debit and credit amounts

- Currency symbols

- Running balances

This ensures you get the data in the correct format right away. With advanced bank statement extraction software, OCR tools can identify fields like transaction amounts, currencies, and running balances, even from complex layouts.

Validation

The system checks the extracted data automatically by:

- Comparing totals with transaction amounts

- Looking out for any missing info

- Giving each extraction a confidence score

- Highlighting any anomalies for a manual check if needed

This step is key to keeping the processing accurate, which is crucial for financial reporting.

Export to Excel, CSV, or JSON

Once everything is validated, you can get your data in the format you prefer: Excel, CSV, or JSON. This makes it easy to import into your accounting software or any financial process.

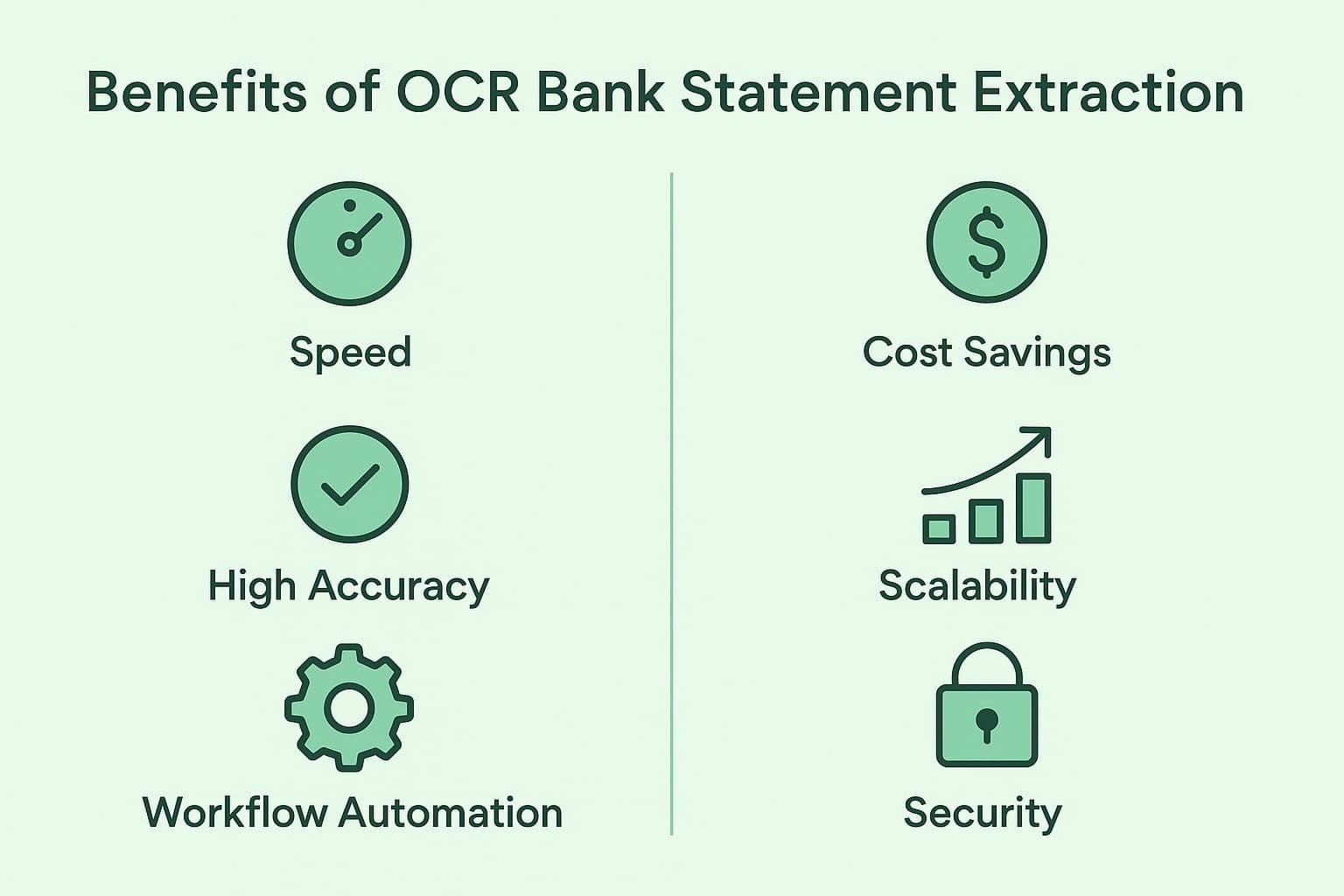

Benefits of OCR Bank Statement Extraction

Extracting data from bank statements using OCR has clear perks compared to doing it by hand, especially for businesses dealing with a lot of financial papers. Here are the main benefits:

Speed

OCR can get through bank statements in seconds, saving hours or days of work. Whether you're handling one statement or thousands, it does the job quickly and consistently, helping you analyze finances in real time and make decisions faster.

High Accuracy

With AI-driven OCR, the chance of human error during data entry drops significantly. It’s good at recognizing text and can handle tricky layouts and scanned documents, making sure transaction details and account info are spot on. The accuracy of OCR for bank statements is thus crucial for financial reporting, verification, regulatory compliance, and decision-making.

Workflow Automation

The data pulled from these statements can easily slot into your existing financial systems, like accounting software or automation tools, without you having to do anything manually. This means your financial processes can run on autopilot, speeding up operations and boosting productivity.

Cost Savings

Cutting out manual data entry reduces labor costs and lets staff focus on more important tasks. With OCR, you can manage data without needing big teams, which also means fewer mistakes and less time lost fixing errors.

Scalability

As your business grows, OCR can handle more data without extra costs. Whether it’s hundreds or millions of documents, it keeps performing well without needing to hire more people.

Security

Financial data is sensitive, and top OCR services like ConvertBankStatement.io make sure your info stays safe. After each conversion, your data is totally removed from our database to ensure maximum privacy.

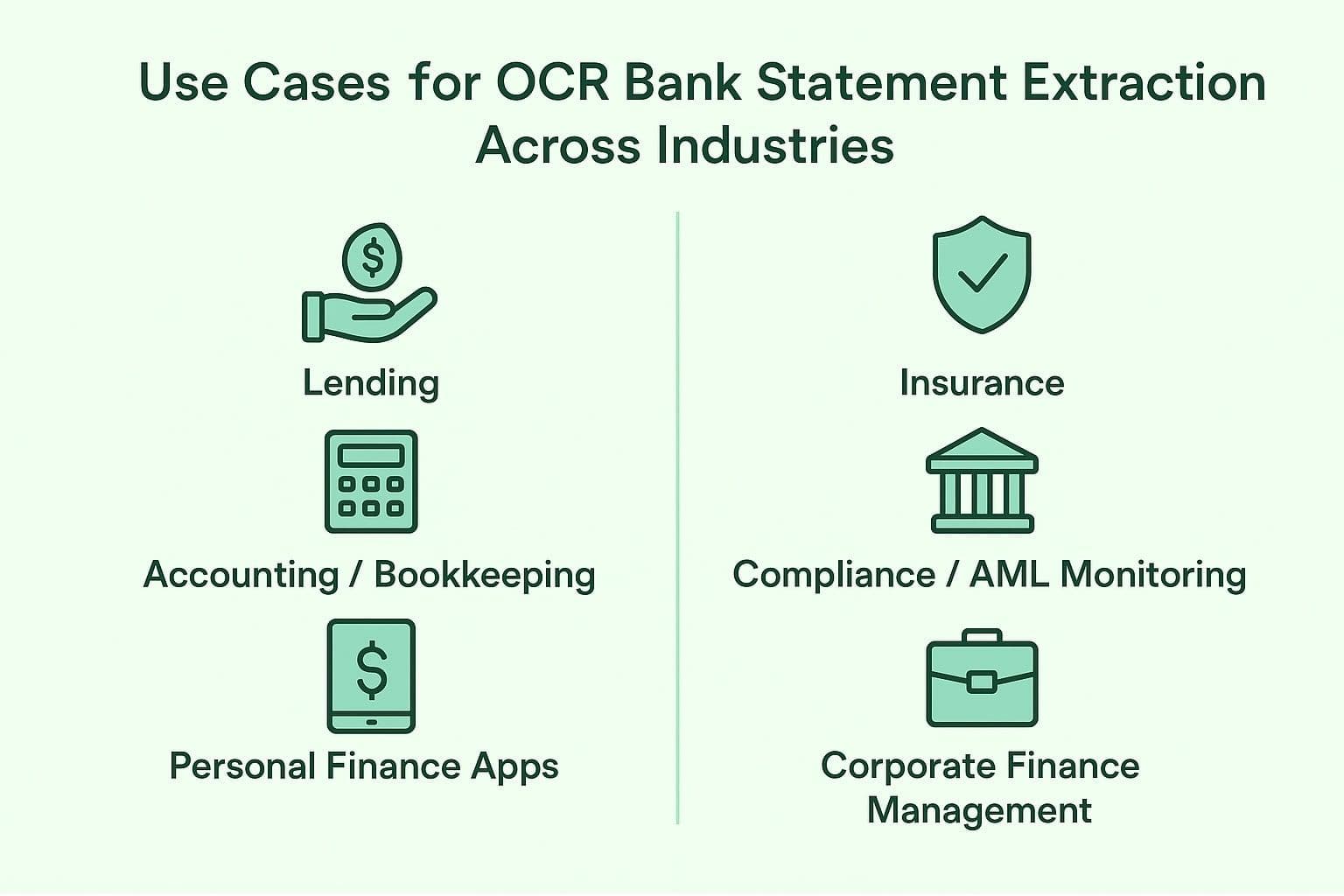

Use Cases for OCR Bank Statement Extraction Across Industries

Many industries rely on effective OCR bank statement extraction, and OCR bank statements have become a go-to option.

Lending

Lenders are using OCR to quickly pull important financial info from bank statements, like income, spending habits, regular payments, and credit amounts. This helps loan officers and risk teams to:

- Speed up loan approvals by cutting down on manual document checks.

- Get a clearer picture of applicants' financial health.

- Help with fully automated underwriting and credit scoring.

- Spot any financial issues that could indicate a risk of default.

By putting precise transaction data straight into risk models, OCR helps lenders make quicker, more informed lending choices.

Accounting/Bookkeeping

OCR cuts down on hours of manual work for accountants/bookkeepers by automatically turning bank statements into:

- Neatly organized transaction lists for easy reconciliation.

- Audit-ready reports

- Accurate journal entries for closing the books.

- Summaries for taxes for businesses and individuals.

This automation saves time and helps cut down on mistakes, making sure everything stays balanced and meets the rules.

Personal Finance Apps

Personal finance apps use OCR to grab user transaction info automatically. This helps with:

- Tracking expenses and budgeting in real-time.

- Sorting spending by store/category.

- Predicting cash flow using past transactions.

- Giving tailored financial advice and tips on saving.

With OCR, personal finance apps let users see their finances right away, so they don't have to enter data by hand.

Insurance

On the insurance side, companies depend on bank statement OCR to check applicants’ incomes, verify payment histories, and keep an eye on regular financial activities. This leads to:

- Quicker decisions on insurance applications.

- Confirming income for disability/life insurance.

- Processing claims to see if someone is eligible for payouts.

- Finding fraud by spotting unusual financial patterns.

Overall, OCR helps insurers work more efficiently while keeping their financial assessments accurate.

Compliance/AML Monitoring

Financial institutions use OCR to pull information from bank statements so compliance teams can handle large volumes of transactions more easily. By extracting this data, they can:

- Spot any suspicious activity that could signal money laundering.

- Automatically keep an eye on large or odd transactions.

- Keep a record of any regulatory checks.

- Make life easier for compliance officers by cutting down on manual work.

Getting the transaction details right is key for keeping up with anti-money laundering rules and reporting needs.

In some cases, institutions may also require certified bank statements as official documentation to meet strict regulatory requirements.

Corporate Finance Management

Big companies and finance teams use OCR to pull in bank data straight into their ERP and finance systems. This helps with:

- Automatic bank reconciliations.

- Keeping an eye on cash flow and managing liquidity in real time.

- Speeding up financial closing.

- Making audits and preparing financial statements easier.

By cutting out manual data entry, businesses can boost their financial accuracy, shorten closing times, and have a tighter grip on their overall financial operations.

How to Extract Data from Bank Statements Using ConvertBankStatement.io?

By cutting out manual data entry, businesses can have better control over their financial operations. With ConvertBankStatement.io, getting data from bank statements is quick, easy, and fully automated, even for tricky PDF or scanned documents. Our platform uses OCR, AI, and machine learning to give you accurate results in just seconds, ready for your needs.

Here’s how it works:

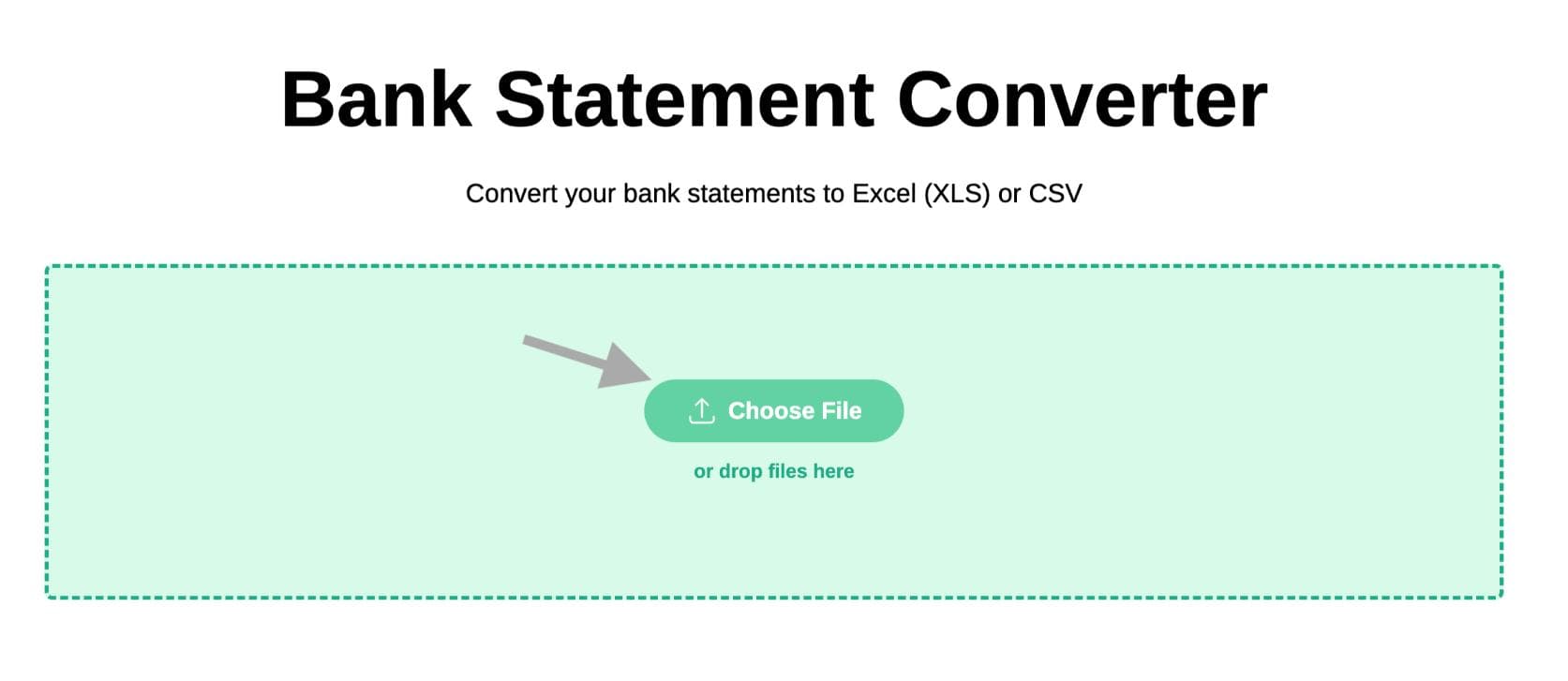

Import Your Bank Statement(s)

Create an account/log in to ConvertBankStatement using the suggested options. Then, click on the green area and select and import your bank statement into the environment.

OCR Data Extraction

Once you select and press “convert,” the statement passes into the stage of OCR data extraction, automatically reading relevant data like:

- Transaction details (dates, descriptions, amounts, currencies)

- Opening and closing balances

- Account numbers

- Statement periods

There's no need for manual input or templates; it’s all fully automated.

Bank Statement Conversion and Download

After the conversion is finished, you can now download your converted file in Excel/CSV format for further processing or copying to your accounting software, whether it is Xero, QuickBooks, or any other.

How to Choose the Right Bank Statement OCR Software?

Choosing the right bank statement OCR software is important for getting accurate results, saving time, and fitting it into your business processes. Here’s how to go about it:

Step 1: Figure Out What You Need and Look for Options

Start by listing what you need from the OCR. Think about:

- How many bank statements will you process each month?

- What details do you need to extract (like transactions, balances, dates, account info, and currencies)?

- Do you need it to work with both scanned PDFs and digital statements?

- What level of accuracy do you need for financial reporting or compliance?

- Do you need the data exported in Excel, CSV, or JSON formats for automation?

- What security standards do you require?

Once you know your needs, look for providers that specialize in bank statement OCR rather than general OCR. Choose solutions that offer great extraction accuracy, solid security, and can handle different bank formats.

At ConvertBankStatement.io, we focus solely on bank statements. We use AI and machine learning with OCR to provide accurate and secure automatic extraction.

Step 2: Check Out Features, Integration, and Cost

Now, take a look at how each option fits into what you already have:

- Data extraction: Does it pull all transaction details automatically?

- Integration: Can it connect easily with your accounting software, ERP, underwriting, or automation tools?

- User experience: Is it user-friendly and simple for your team to pick up?

- Output options: Can you quickly export to Excel, CSV, or JSON?

- Scalability: Can it handle more statements as your business gets bigger?

- Total cost: Think about subscription fees, integration costs, and how much you’ll save in the long run from less labor, fewer mistakes, and quicker processing.

Picking the right OCR software isn't just about the features - it's about how well it can grow with you, keep your data accurate, and automate your workflows.

Conclusion

In conclusion, OCR bank statement extraction makes it a lot easier to turn messy financial documents into neat data. With the help of OCR, AI, and machine learning, businesses can skip the tedious manual data entry, make fewer mistakes, and quickly deal with lots of statements.

This technology comes in handy for lending, accounting, fintech, compliance, and corporate finance. It helps companies automate financial tasks, keep their data accurate, and make better choices while staying within the rules.

Get Started with ConvertBankStatement.io’s OCR Bank Statement Technology

Check out how OCR technology can make it easier to get information from your bank statements. We at ConvertBankStatement.io use smart OCR to pull out transactions, balances, and account info from scanned PDFs.

Say goodbye to typing everything in by hand and the mistakes that come with it. Just upload your statements, get clean data, and quickly export it to Excel, CSV, or JSON.

Try ConvertBankStatement.io today and make managing your bank statements fast and easy.

FAQ

What is OCR bank statement extraction?

OCR bank statement extraction is a process that uses Optical Character Recognition (OCR) along with AI and machine learning to turn scanned or digital bank statements into organized data that can be read by machines, like Excel, CSV, or JSON files.

How accurate is OCR for bank statements?

When you start with good-quality documents and use advanced OCR technology, the accuracy of extraction can reach between 95% and 99%. It mostly depends on how well the scans are done and how complex the layout is.

What data can OCR extract from bank statements?

OCR can pull out a bunch of financial details from bank statements, such as transactions (which include dates, descriptions, amounts, and currencies), account balances, account numbers, and the period the statement covers.

Is OCR extraction secure for financial data?

Absolutely. Usually, the best OCR services stick to strict security measures, like encryption and compliance. This helps keep sensitive financial info safe.

What output formats are supported?

You can export the extracted data into formats like Excel (.xlsx), CSV (.csv), and JSON (.json). This makes it easy to use in accounting, underwriting, or automation tasks.