Bank Statement Analysis: Key Steps, Benefits & Use Cases

Bank statement analysis comprises a thorough research of balances, bank charges, income sources, and overall financial health.

Specifically, companies requiring prompt data-supported decisions have found bank statement analysis an incredibly valuable resource. By turning raw transactional data into actionable information, organizations can assess financial behaviors more accurately, identify credit risk sooner, and comply with regulatory requirements.

There are additional uses for bank statement analysis, such as recognizing inefficiencies in operations, for example, excess bank fees, cash flow leakage, or late payments, that otherwise would not be noticed in larger financial summaries. Thus, a bank statement analysis makes day-to-day banking data an organizational advantage.

What Is a Bank Statement Analysis?

Bank statement analysis refers to reviewing someone's bank transactions to understand how they earn, spend, and manage money.

It is used by any type of professional - lenders, for example, to see if a person qualifies for a loan, accountants managing expenses, treasurers considering cash flows, and business owners wanting to keep their books in good standing.

Why is this important? Because bank statements tell a story. They may show consistent income or that a person is struggling with their finances.

They can help determine if fraud has occurred, if there is an unusual set of transactions, or if someone is trying to create fake documents. Some estimates call for up to 90% of financial crimes to be caught sooner with solid risk bank statement analysis.

Whether preparing an income and expenses report, taking a loan application, or finding missing charges, bank statement analysis will help make better financial decisions. As businesses grow and expand, automating the interpretation of bank statement data will help save time, avoid costly mistakes, and streamline audit preparation.

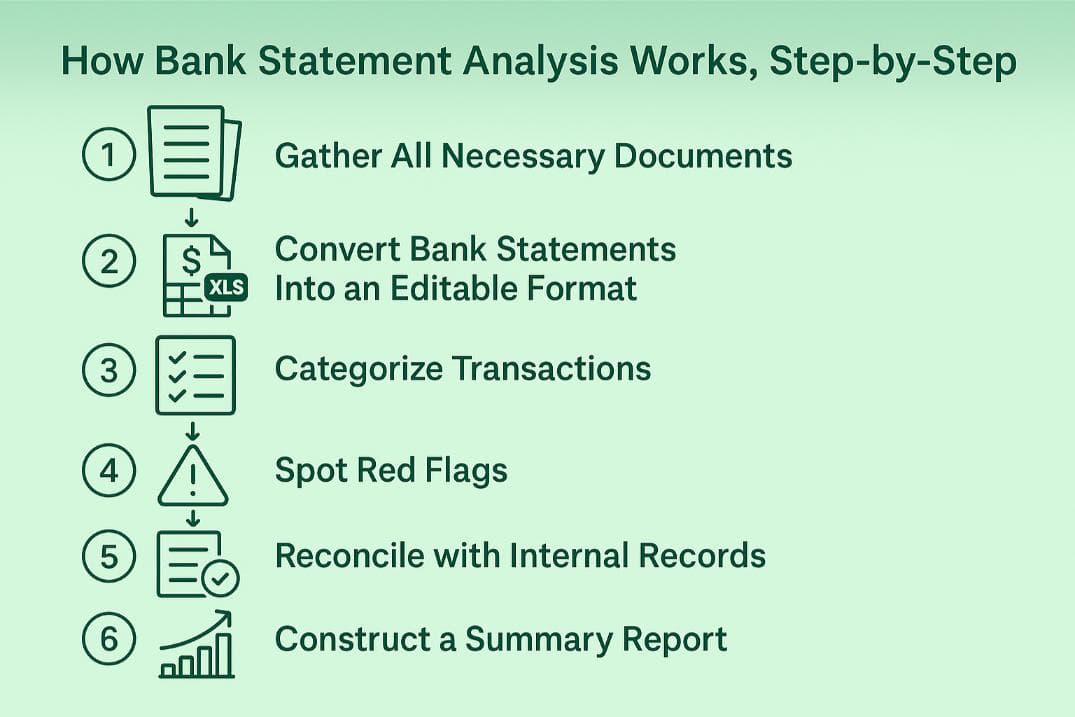

How Bank Statement Analysis Works, Step-by-Step

A bank statement analysis isn't simply about looking at the balances - it is also about turning the raw transaction data into useful financial insights. Whether you're an accountant, lender, or business owner, this structured approach will help you determine the financial health of a company, deny or prove fraud, and submit your reports with accurate confidence.

1. Gather All Necessary Documents

First, collect all bank statements you’d like to analyze. This includes documents like scans of all bank statements for the entire time period being reviewed. If there are missing months, it could indicate overlooking a critical bank transaction.

2. Convert Bank Statements Into An Editable Format

Converting bank statements into editable formats like Excel (XLS) or CSV is important for a successful bank statement analysis. This conversion makes bank data interpretation easier, especially for larger volumes.

ConvertBankStatement.io simplifies this process by using OCR to convert bank statements into Excel or CSV formats, creating a bank extract. Furthermore, it makes things easier by creating a ready-made format to be input into the respective accounting software, like Xero and QuickBooks.

With ConvertBankStatement, you get top safety with advanced SSL technology encryption with every conversion. Rest assured - your information is completely safe with us. After conversion, your data is removed from our systems to ensure maximum privacy.

3. Categorize Transactions

After the data has been extracted, arrange each bank transaction into the following categories:

- Income (i.e., salaries, sales revenues)

- Expenses (i.e., fixed costs, variable costs)

- Transfers or loan repayments

This step provides a foundation for a clear income and expense report that can be used for budgeting, underwriting, or tax preparation.

4. Spot Red Flags

Look for unusual patterns in your categorized data, such as:

- Round transactions

- Unexplained overdrafts

- Duplicate or backdated transactions

- Large, suspicious spikes in spending

These red flags often uncover during an extensive bank statement audit, and can indicate fraud, error, or reporting inconsistency.

5. Reconcile with Internal Records

Finally, once you have the extracted data, compare it against your internal accounting records. This adds an additional level of assurance that your statement is a reflection of reality and catches any discrepancies early.

6. Construct a Summary Report

You can create a summary report now that you have the clean data. This summary could include cash flow graphs, expense charts, trend lines, etc. A well-structured bank statement analysis will offer actionable insights to decision-makers.

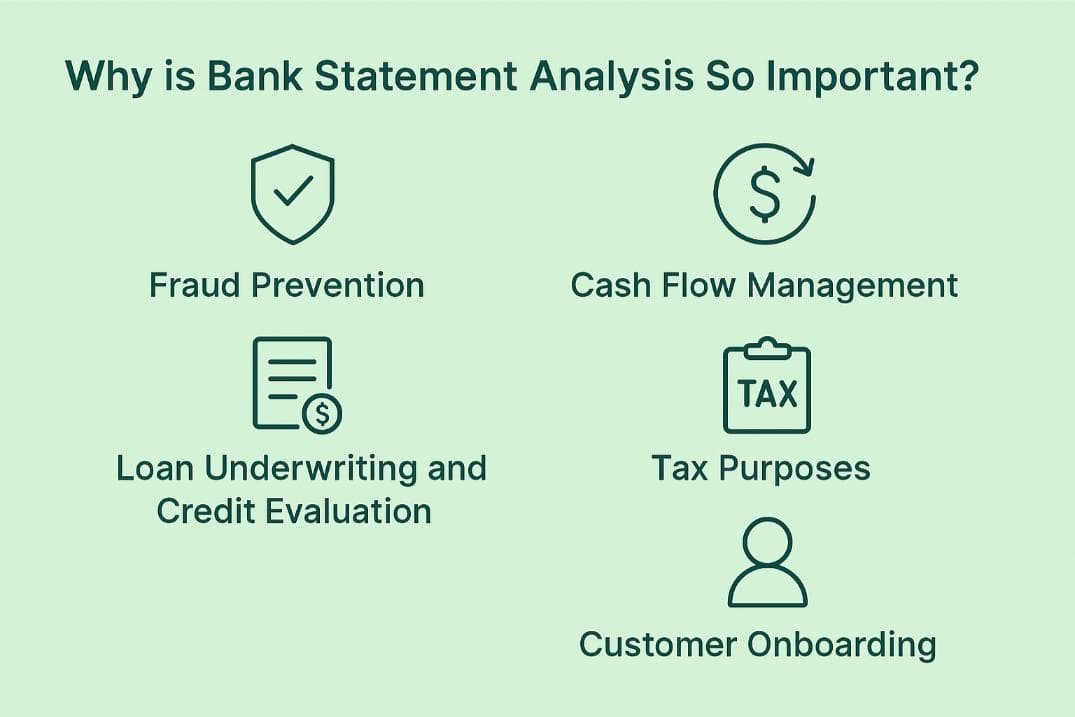

Why is Bank Statement Analysis So Important?

A solid bank statement analysis not only offers numbers, but also thorough glimpses into an individual's or business's financial health. From making lending decisions to detecting fraud, here is how and why bank statement analysis is important:

Fraud Prevention

When it comes to fraud, the most comprehensive look into financial behaviors comes through bank statements. Certain abnormalities in bank statements (e.g. manipulated PDFs, mismatched formatting, or repeating micro-transfers) could indicate fake bank statements or money laundering.

Reviewing statements, as part of the IML/KYC compliance, helps ensure customer due diligence and reduces regulatory risk.

Loan Underwriting and Credit Evaluation

Lenders use bank statement analysis as part of every applicant's credit evaluation process to assess income stability, cash flow consistency, and capacity to pay the loan back.

Analyzing the applicant's bank transactions could, for example, reveal consistent overdrafts, bounced checks, or undisclosed debts with other creditors. This can help determine credit limits, proposed interest rates, and terms of loans.

Cash Flow Management

Effective cash flow management is more than simply tracking - it's about taking effective action. When businesses identify more details on their cash flows, they can leverage cash to improve working capital, negotiate better terms with suppliers, and untap investment opportunities.

Tax Purposes

Bank statement analysis contributes to tax calculation, which helps in computing for ITR (Income Tax Return) filings and income tax returns themselves, for NBFCs and fintech startups. Analyzing bank statement transactions enables the estimation of tax payable on an annual basis. It aligns reported income with actual financial activity, ensuring the authenticity of a transaction.

Customer Onboarding

Banks often would like to take a look at bank statements from customers during the onboarding process for identity verification and examining their financial behavior. This quick financial health screening helps them to weed out risky customers before offering them services.

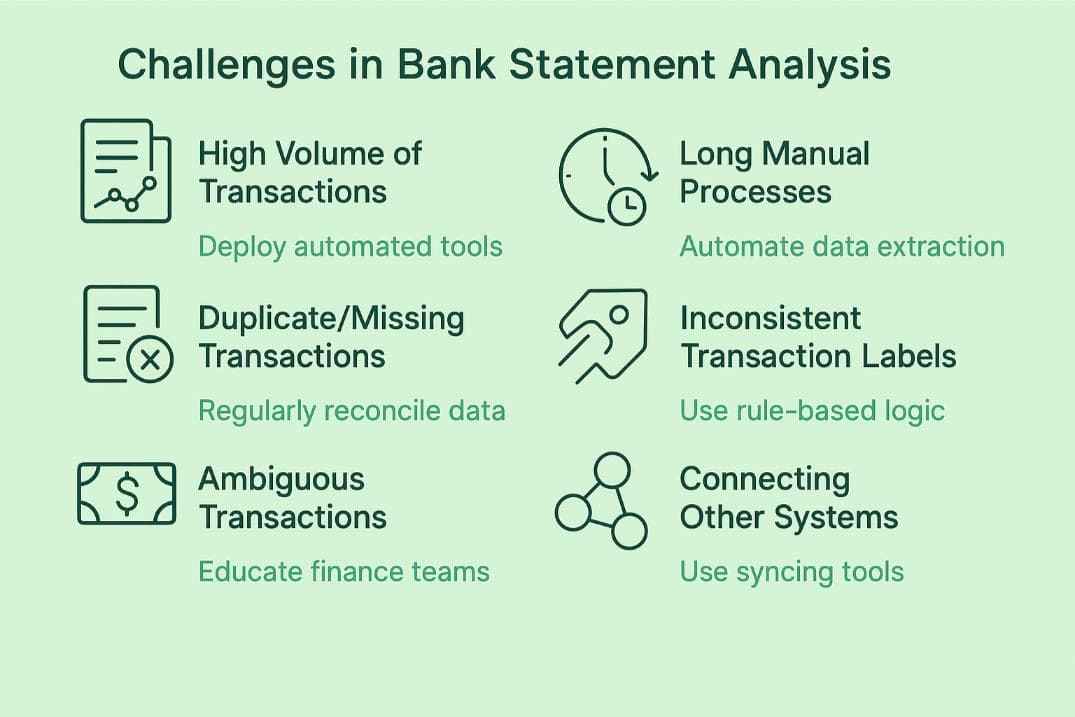

Challenges in Bank Statement Analysis

Talking about the benefits of bank statement analysis, it is important to highlight some related challenges, too. Below are some common ones and practical solutions to overcome them:

1. High Volume of Transactions

Analyzing thousands of transactions spread across multiple bank accounts may quickly become overwhelming for large organizations.

Solution: Deploy automated tools that classify and summarize data. This not only increases the speed of bank data interpretation but also reduces the probability of human errors.

2. Long Manual Processes

Manual processes involving data entry, sorting, and reporting can take way too long and call for fatigue-based mistakes.

Solution: Automate data extraction - convert from PDF to CSV/Excel to reduce the time spent on manual conversion. Try ConvertBankStatement.io for free.

To speed things up, you can rely on a solution like bank statement extraction software that removes the need for data entry altogether.

3. Duplicate/Missing Transactions

Finding duplicate transactions or missing transactions in exported files is not unusual, and this will contribute to discrepancies in reports.

Solution: Regularly reconcile your bank data back to your internal records, and use tools to identify anomalies in real time.

4. Inconsistent Transaction Labels

Vendors and payment processors often inconsistently depend on naming conventions that complicate the categorization of items.

Solution: Use software that applies rule-based or machine-learning logic to identify similar transactions even if they are described differently.

5. Ambiguous Transactions

Transactions related to foreign exchange or financial derivatives, for example, may be difficult to classify without specific domain knowledge.

Solution: Educate finance teams around language in 'niche transactions' or use software specifically designed to handle complex formats.

6. Connecting Other Systems

Bank statement data sometimes needs to be integrated with other software, like QuickBooks.

Solution: Use tools that will allow for easier syncing. With ConvertBankStatement.io, you can easily insert your converted statement into any accounting or other software you want, especially if you're integrating via an automated bank statement API for continuous syncing.

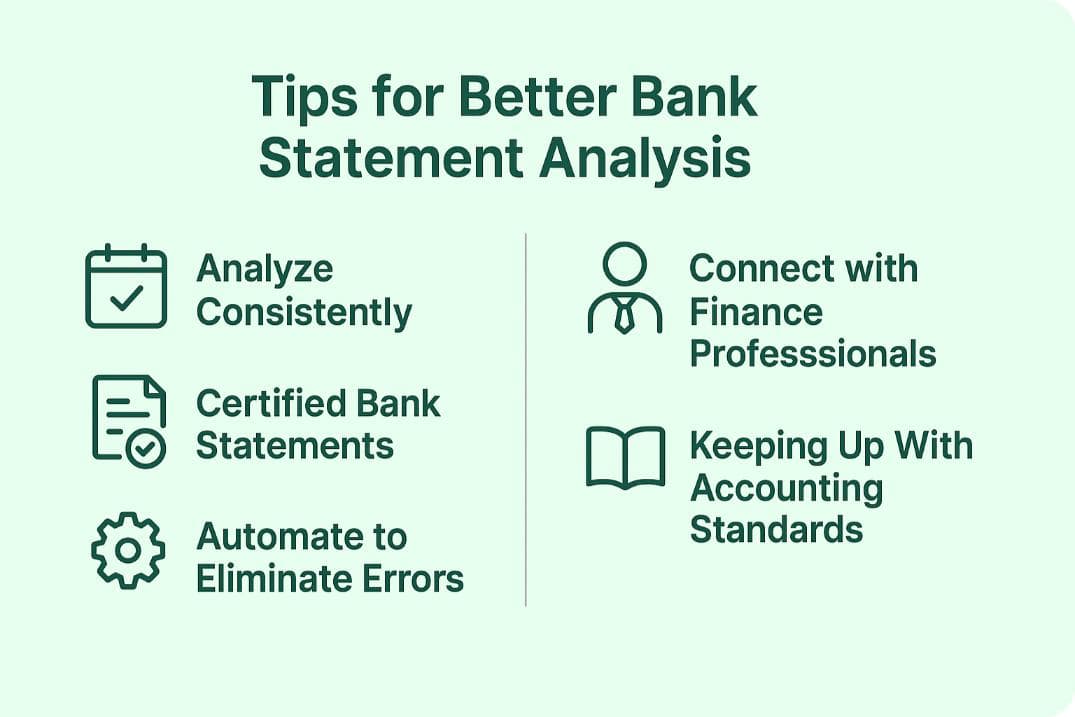

Tips for Better Bank Statement Analysis

To get the most value out of your bank statement analysis, you will have to go beyond a simple one-time review and establish a habit ensuring accuracy, compliance, and efficiency. Here are a few widely accepted practices for effective bank statement analysis on a long-term basis:

Analyze Consistently

As with all financial processes, you should maintain a recurring schedule for your analyses. Consider doing a bank statement analysis at least monthly or quarterly to determine where you can catch (if at all) errors.

Frequent analysis will also help you avoid the bottlenecks during an audit or tax season.

Certified Bank Statements

Always directly ask for certified bank statements. If you are using any form of unverified document, you may be accepting the risk of manipulated data, which might lead to doubts about the integrity of your bank statement audit.

Automate to Eliminate Errors

Entering information by hand will lead to errors, especially when analyzing data in a large volume. Automating the extraction, categorization, and interpretation of bank data to get insight quicker will save time and reduce potential risk.

Connect with Finance Professionals

While automated procedures will standardize the processes and make the results valuable, the contribution of a financial professional can help add value as well.

They can assist with the interpretations of complex line items, provide strategic contributions, and identify patterns that an automated system might not see the same way. Doing this together with your tools will add more value to your overall analysis process.

Keeping Up With Accounting Standards

Accounting standards evolve in line with new financial practices. If you keep yourself knowledgeable of the current reporting standards, you’ll automatically align your analysis with current regulatory requirements and practices.

Conclusion

In today’s fast-paced financial environment, bank statement analysis has transitioned from a mundane compliance task into an essential input into decision-making, risk assessment, and strategic planning.

Whether you are a lender evaluating creditworthiness, a treasurer managing liquidity, or a business owner keeping an eye on expenses, analyzing bank transactions provides a clear window into financial health.

By creating structured routines and using automated tools, you can develop workflows that minimize errors and increase the probability of identifying fraud or financial errors. Bank data analysis is no longer just a process - it does provide a competitive advantage.

With smarter systems in the market, now is the time to invest in them to help you automate, analyze, and protect your finances.

FAQs

1. Why do I need a bank statement analysis?

Bank statement analysis allows individuals and companies to examine their financial actions by reviewing income, expenses, and patterns in bank transactions. Bank statement analysis can be used for credit or loan purposes, fraud prevention, budgeting, and preparing income and expense reports or audits.

2. What are standard fraud markers in bank information?

Fraud markers can include round-numbered transactions or repeated micro-deposits, unexplained overdrafts, duplicate payments, or mismatches between income reported and deposits made. Regular bank statement audits will investigate these fraud markers to identify irregularities.

3. What is the difference between analysis and reconciliation?

Bank statement analysis allows the user to analyze trends and behaviors from financial data. Reconciliation focuses on matching the transactions on the bank statement to the transactions in internal accounting records to ensure accuracy.

4. What is the best way to categorize bank transactions?

Start categorizing bank transactions into primary categories like income, fixed expenses, variable expenses, transfers, or any other category you might find useful. You can also choose automation tools or templates with consistent rules that would treat each bank transaction logically while separating them accurately.

5. Is performing bank statement analysis helpful for tax preparation?

Absolutely! Bank statement analysis is especially useful during tax season, as you can confirm that your reported income matches the amount deposited and that you have proper documentation for all deductible expenses. It is often used by NBFCs, fintechs, and accountants as a basis for ITR filings and compliance with other tax requirements.