How to Read a Bank Statement

Your bank statement is not just boring numbers. Think of it as a monthly peek into your financial situation. Whether you're keeping tabs on your spending, freelancing, or running a business, it shows where your money goes.

Knowing how to read it helps you:

- See where your money is going

- Find sneaky fees/mistakes

- Spot scams

- Budget better

But let's be real, bank statements can be confusing. Lots of weird codes and messy info!

That's exactly why we created this guide. We want to help you understand your statements without feeling lost.

So, if you're a solo entrepreneur, an accountant, or just trying to be better with money, this is for you.

Let’s get started!

How to Read a Bank Statement (With a Visual Guide)

Bank statements can seem confusing, but they’re actually pretty easy to read once you know what to look for. We’ll show you the key parts using a real statement example.

Here's how to read your bank statement:

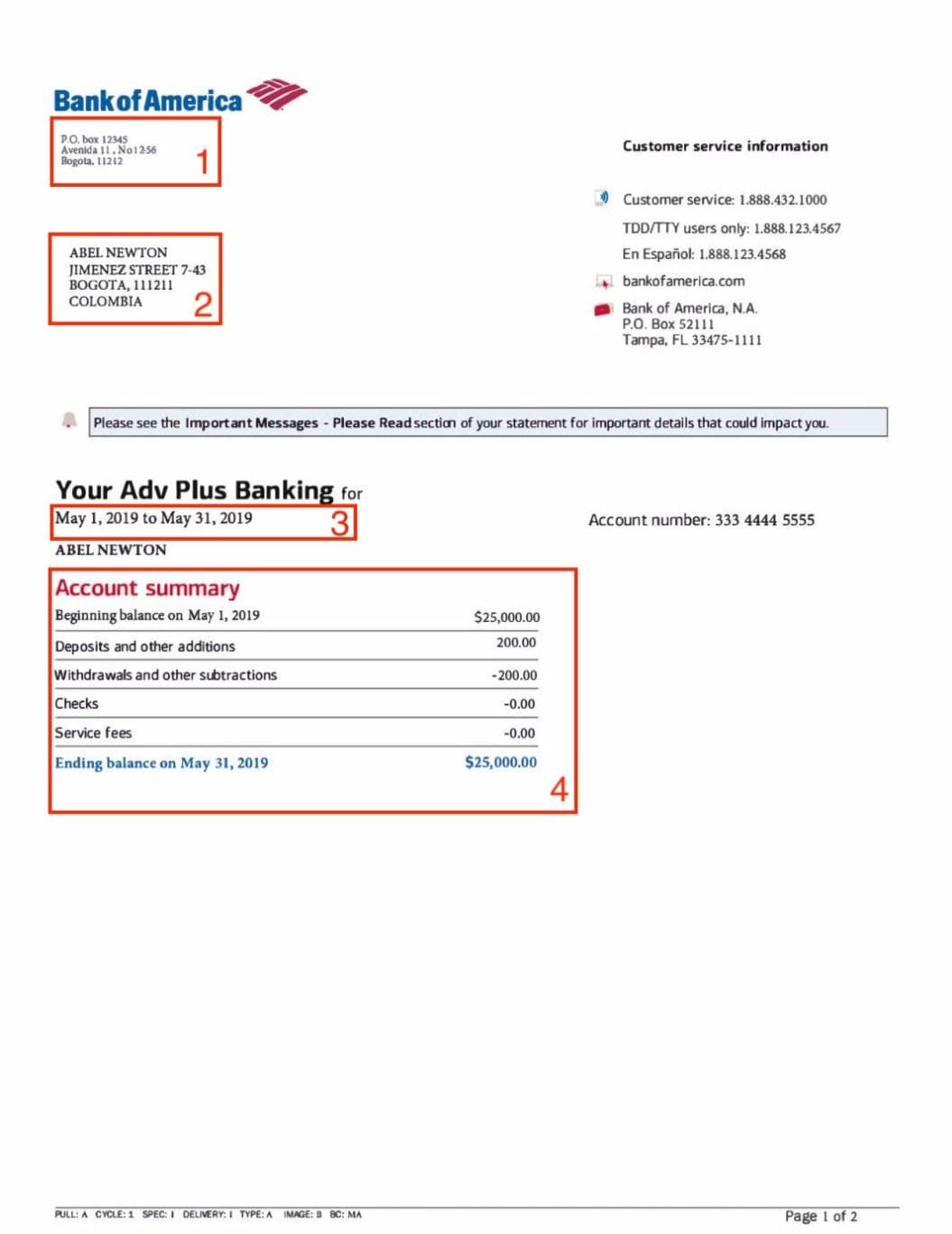

1. Check Bank Information: Make sure the bank's name, logo, and how to reach them are at the top.

2. Review Your Information: Make sure that your name and address are correct.

3. Confirm the Dates: Find the dates the statement covers.

4. Review the Account Summary: Take a look at your starting balance, how much you put in, how much you took out, and your final balance.

5. Scan Your Deposits: Check for things like your paycheck, refunds, and transfers that came in.

6. Review Withdrawals: Review where your money went - expenses, ATM trips, and purchases.

7. Check If There Are Any Fees: See if you’ve got any charges like overdrafts, monthly fees, or ATM fees.

We've marked up the sample statement below with numbers to match each section, so it’s easy to follow:

- Bank Info - Up top, you’ll see the bank’s name, logo, and address. This tells you who sent the statement.

This helps you know it's really from the bank, which is handy if you have questions or need to give them a call. - Customer Info - Right below the bank’s info, you’ll find your name and address. This confirms it's your statement.

Make sure all your info is right. If it's wrong, it can mess things up when you apply for loans, verify your identity, or do your taxes. - Statement Dates - This shows you what period the statement covers. Always double-check the dates to make sure you’re looking at the right time frame. This is super important when you’re balancing your accounts or doing an audit.

- Account Overview - This gives you a quick look at what happened in your account during the month.

It includes:

- Starting balance

- Total deposits (money in)

- Total withdrawals (money out)

- Ending balance

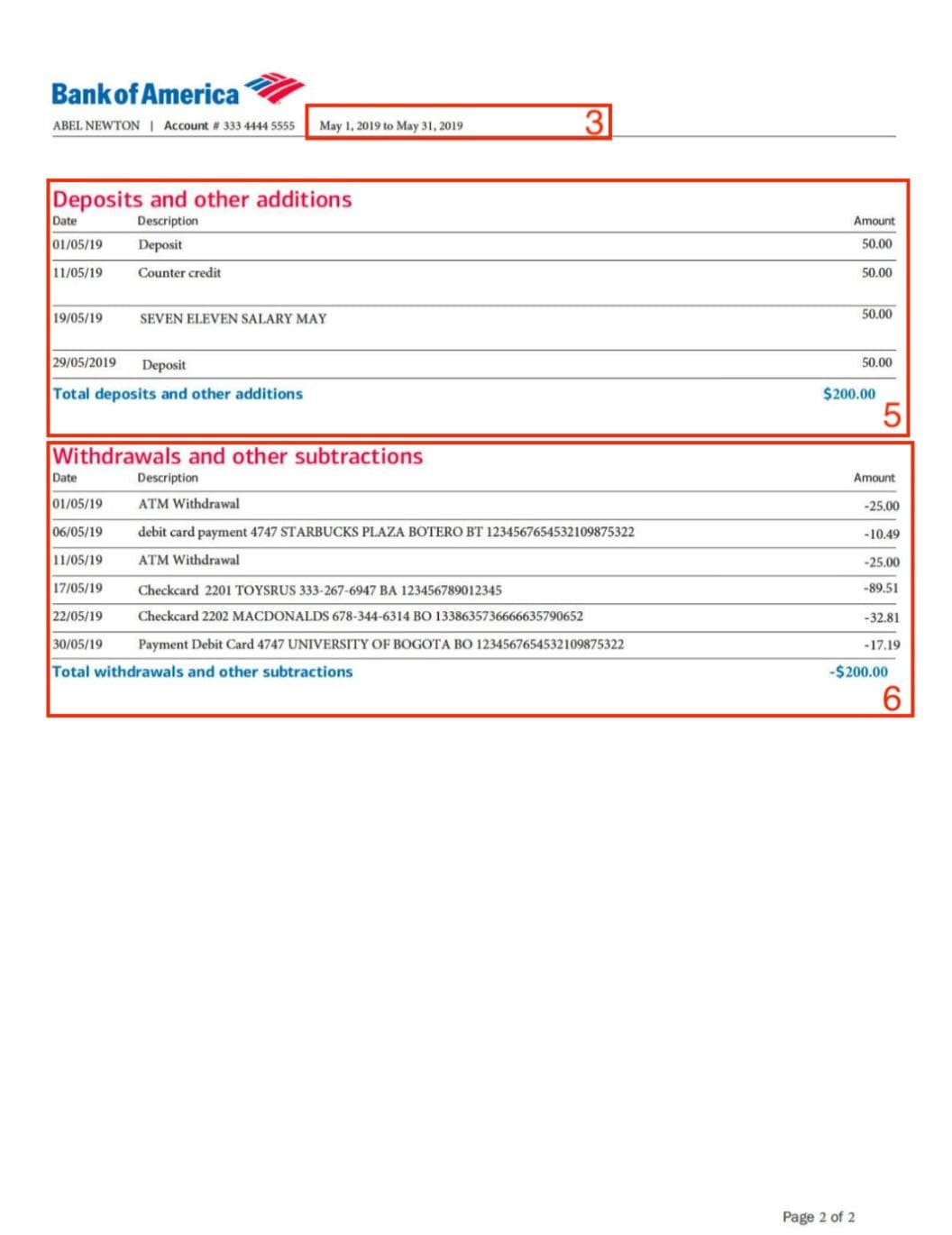

This section lets you quickly see how much money came in, how much went out, and what you ended up with. - Deposits - This lists all the incoming money during the statement period.

Each deposit shows:

- Date

- Description

- Amount

This covers things like your paycheck, refunds, transfers, or cash you put in. - Withdrawals - This section lists all the money that has left your account.

It’s usually the longest part of the statement.

Similarly, each withdrawal shows:

- Date

- Description

- Amount

Make sure every withdrawal is something you authorized and that the amounts are correct.

This is where you’ll spot any fraud or double charges. - Fees (if any) - There weren’t any fees in our example. But usually, statements can show:

- Overdraft fees

- Monthly fees

- ATM fees

Why It's a Good Idea to Read Your Bank Statement

Looking at your bank statement isn't just about seeing your balance. It's about being in charge of your money.

Whether you're watching your own spending or handling a business, checking your bank statement regularly can keep your money safe and help you make better choices about it.

Here's why understanding your bank statement is important:

See Where Your Money Goes

Your bank statement shows every transaction, from subscriptions to impulse buys. By checking it each month, you can see exactly where your money is going. This can help you find habits, cut unnecessary expenses, and stick to your saving goals.

Spot Unauthorized Charges or Fraud

Scammers often start with small charges, especially if your bank statement isn’t from a verified source. Using a certified bank statement helps reduce the risk of fake or manipulated documents.

Actually, lots of people are scammed every year. Simply looking at your statement could save you money.

Avoid Unnecessary Fees

Overdraft fees, monthly charges, foreign transaction fees - they can add up. Your bank statement shows all of them. You can find charges you don't need, question errors, or get a better bank account if needed.

Get Ready for Taxes or Loan Applications

Do you need to show proof of income for a loan? Or get papers for your accountant during tax time? Your bank statement is an important document that helps prove your cash flow, especially if you work for yourself.

Easily Check Your Finances

Want to understand your finances better? You can turn your statement into a spreadsheet to watch your monthly cash flow, sort transactions, or plan future budgets.

What to Do If You Find an Error on Your Bank Statement

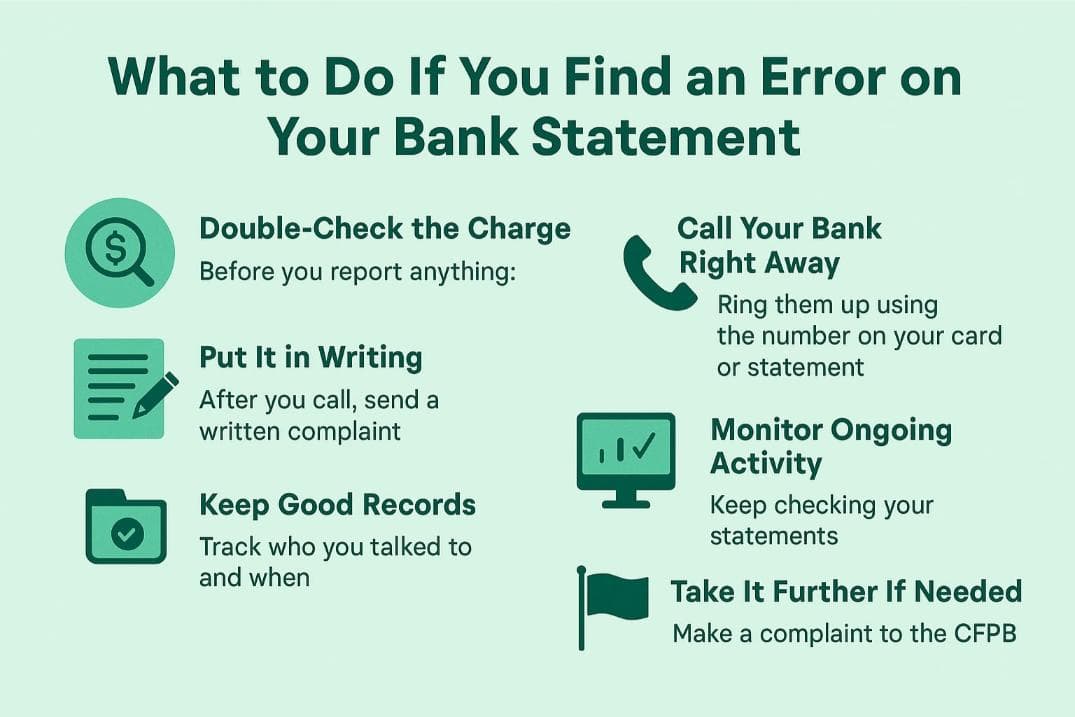

Spotting an error on your bank statement can be a real headache, but here’s what you can do to sort it out and keep your funds safe.

Know the Rules

According to the Electronic Fund Transfer Act (EFTA), you have 60 days from when the statement was issued to question any unauthorized electronic transaction.

If you miss that deadline, you might not get the protection you’re supposed to.

1. Double-Check the Charge

Before you report anything:

- Look through your receipts, email alerts, and calendar.

- Ask anyone who uses your card.

- A lot of weird charges are just minor mistakes or payments you forgot all about.

2. Call Your Bank Right Away

- Ring them up using the number on your card or statement.

- Tell customer service to flag the charge and ask for a temporary refund if it turns out the transaction wasn't authorized.

- Many banks will give you a temporary credit while they look into it, especially if you act fast.

3. Put It in Writing

- After you call, send a written complaint through a secure message or email.

- Include your account info, the date and amount of the charge, and why you think it's wrong.

- Make sure to save copies of everything you send - banks might need them for their records.

4. Keep Good Records

Keep track of:

- Who you talked to and when

- Any reference or case numbers

- Screenshots of any suspicious transactions

- Copies of all your written stuff

This info will back you up if things drag on or if you don’t see your refund within the expected 10 business days.

5. Monitor Ongoing Activity

After you report the problem, keep checking your statements for:

- Any other unauthorized charges

- Refunds or reversed transactions

- Updates from your bank about fixing the issue

6. Take It Further If Needed

If the bank doesn’t sort things out:

- Make a complaint to the Consumer Financial Protection Bureau (CFPB).

- Some issues, like identity theft, might also need a police report.

How to Turn Bank Statements into Excel or CSV for Analysis

Looking at your bank statement is good, but really using it is where it gets helpful. Spreadsheets are the best way to do that.

If you're handling your own money, getting ready for taxes, matching up client accounts, or checking business spending, turning your bank PDFs or scans into Excel or CSV makes everything quicker and simpler.

Why Convert Your Bank Statement?

Most bank statements are just PDFs that don't change, so it's tough to search, sort, or figure things out. Putting them into Excel or CSV means you can actually use them to:

- Keep tabs on income and spending by type

- Make dashboards that change to help with budgeting or cash flow

- Make business bookkeeping or accounting easier

- Automatically get your taxes ready with a list of what you can deduct

- Check lots of things at once

- Give easy-to-read data to your accountant, advisor, or business partner

If you're a freelancer, business owner, or on a finance team, this turns your statement into something you can really use.

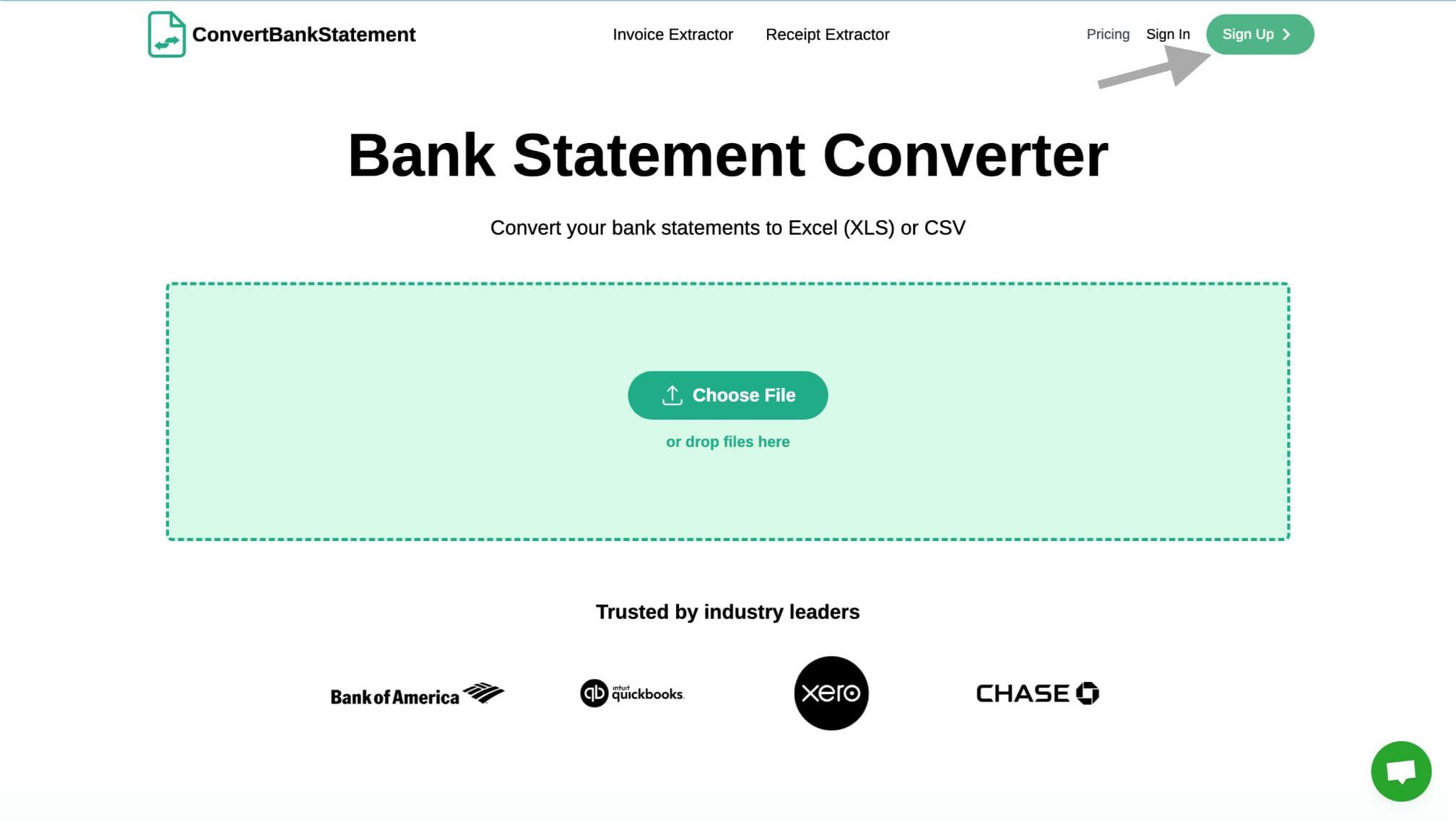

Instead of typing everything out or using iffy scanning programs, you can rely on modern bank statement extraction software like ConvertBankStatement.io to automate the process.

Whether it’s Capital One, Chase, or Citi, Convertbankstatement.io works with all bank statement formats.

Here’s how to do it:

- Create an account/log in using the suggested options.

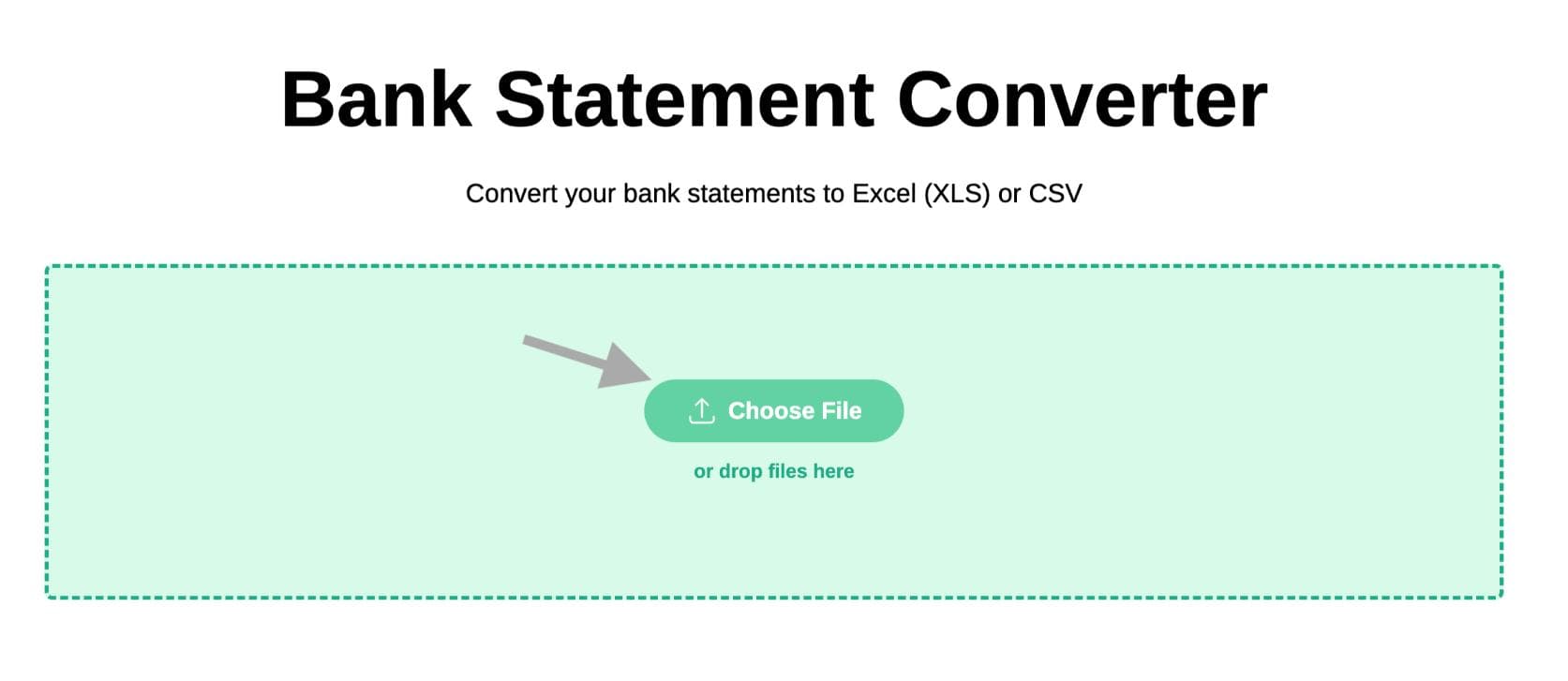

2. Click the “Choose File” button or drag and drop your file into the green area.

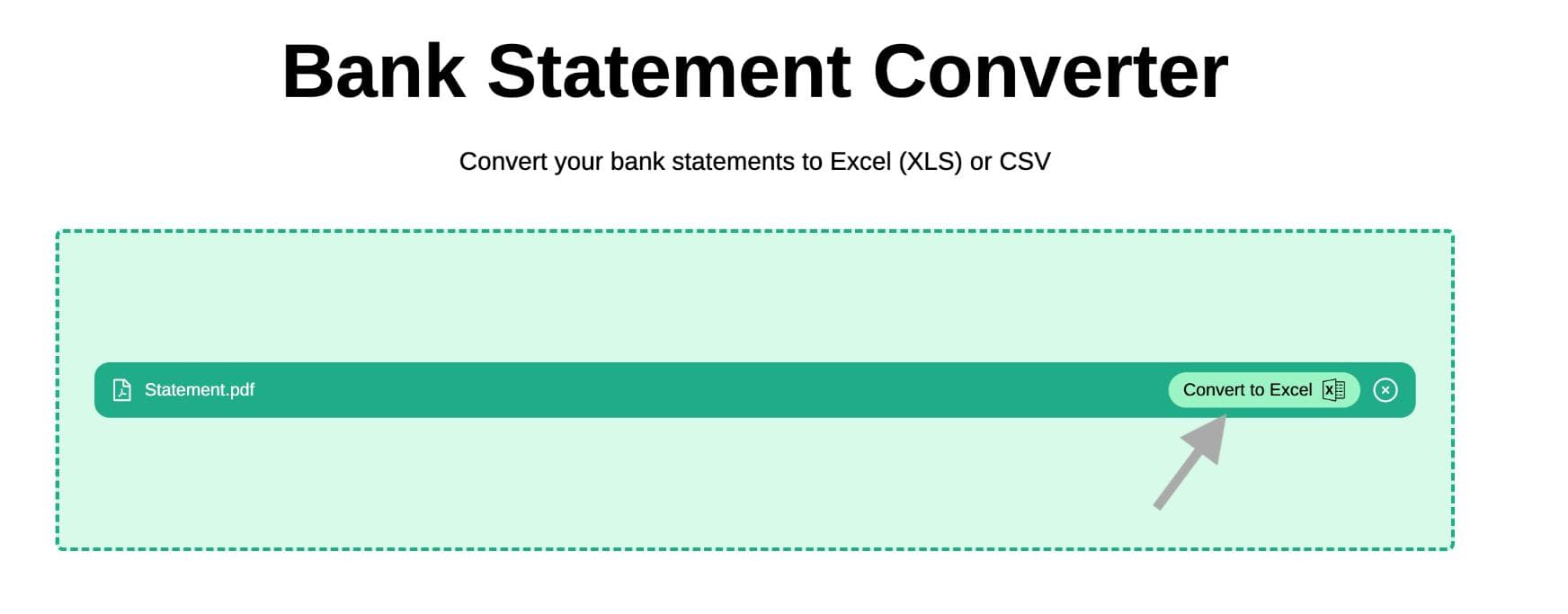

3. Select the required PDF file, and click the Convert to Excel button

Our OCR engine will find and extract:

- Transaction info (date, amount, description)

- Balances

- Account number

- Totals, fees

No need to format or retype, it's super quick.

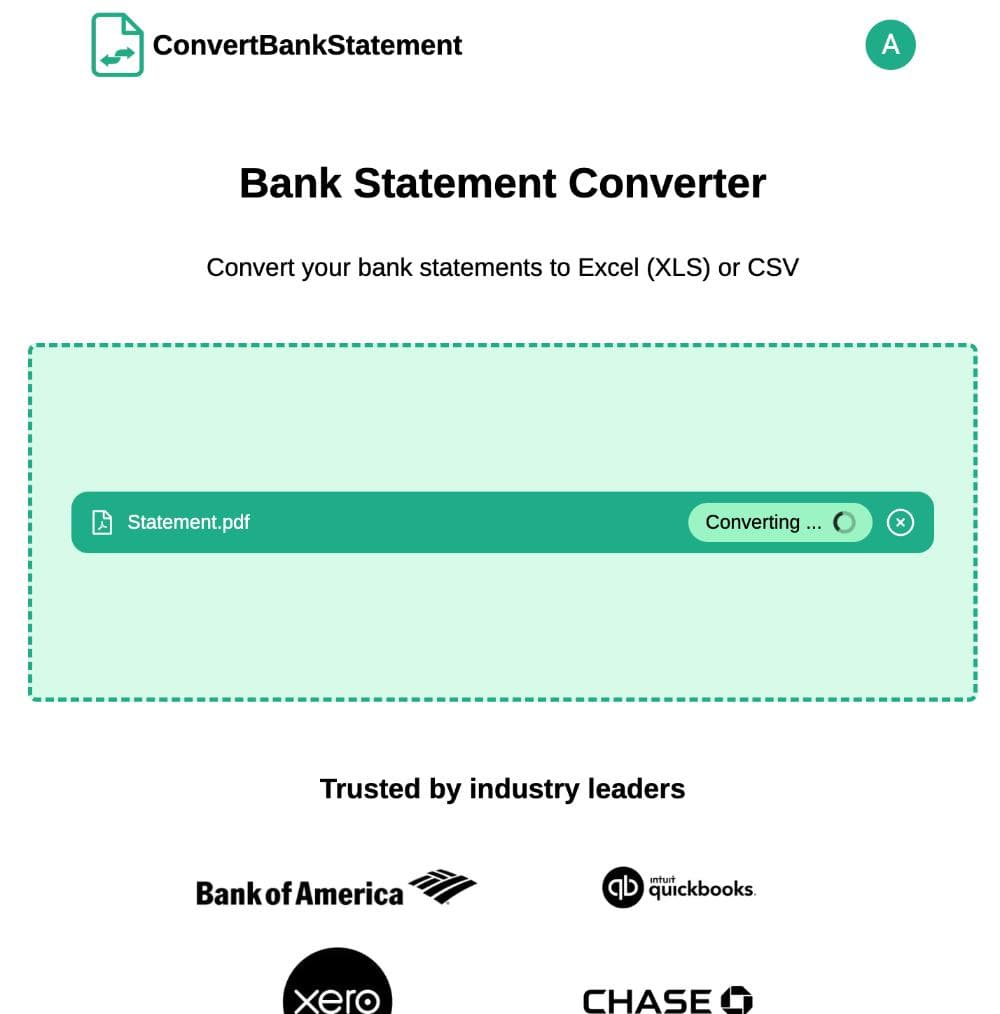

4. Your environment should look like this by now:

5. And that’s it! After the conversion is finished, you can now download your converted bank statement in Excel/CSV format for further processing or copying to your accounting software.

Advanced Tips for Reviewing Your Bank Statement

So, you've figured out how to read your bank statement, great! Now let's look into how to use it and learn about your financial situation.

These tips will let you get the most out of your statement, or you can go deeper with bank statement analysis to track trends, fraud, or financial performance over time.

1. Sort Your Transactions

Sort where your money goes, like:

- Food shopping

- Restaurants

- Travel

- Memberships

- Work costs

This can show you where your money goes and help you spend less if you want.

2. Know What Costs the Same Each Month and What Changes

Some costs don't change much each month (like rent), while others do (like eating out).

Knowing the difference can help you plan your spending and see where your money is headed.

3. Find Patterns

Look at your statements from the last few months and think:

- Am I spending more on food or trips lately?

- Do I have memberships I don't even use?

- Did any company charge me twice?

Looking at patterns like this can be very helpful.

4. Watch Your Money Movement

Instead of just looking at the total in your account, see how your money moves.

- Do you almost run out of money in the middle of the month?

- Do you get lots of small payments or just one big one?

Knowing when your money comes in and when it goes out can help you avoid overspending and missing payments.

5. Double-Check Your Statement

Make sure every transaction line up with your receipts, bills, or records. If you have a business, this is super important to avoid financial mistakes.

Conclusion

Looking over your bank statement? It's not just about seeing how much money you have. It's also about keeping your money safe, catching errors, and making smart choices.

With Convertbankstatement.io, you can quickly convert any PDF or scanned statement into a neat, easy-to-search Excel or CSV file. It’s great for budgeting, audits, taxes, or just balancing your accounts.

Save effort. Cut down on mistakes. Manage your money better. Give Convertbankstatement.io a shot today.

FAQs

- How can I get a better understanding of my bank statement?

To figure out your bank statement better, check out the sections at the top first:

- Bank details (name, how to reach them)

- Your account info (name, number, where you live)

- Statement dates

Then, look at the quick view of what happened (how much you started and ended with, and how much came in and out), and then go through each transaction one by one to make sure it's all good.

What do all the numbers on a bank statement mean?

The numbers show what happened in your account:

- Starting amount - how much you had at the beginning

- Deposits - funds coming in

- Withdrawals - payments or buys

- Ending balance - what's left at the end

Other numbers might be transaction IDs, check numbers, or codes that help you keep track and sort out any mix-ups.

Why should I review my bank statement every month?

Checking your statement often helps you:

- Spot charges/mistakes you didn't make

- Keep an eye on where your money goes and stay on budget

- Skip extra charges or going into overdraft

- Have proof for loans or taxes

What important items should be on every bank statement?

A bank statement usually should have:

- Your name and where you live

- Account number and what kind of it is

- What time period it cover

- A quick look at your amounts (start, end, how much in/out)

- A list of all the money in, money out, and charges

- How to reach the bank

What kind of transactions usually show up on a statement?

Transactions you'll often see include:

- Direct deposits (paychecks, transfers, refunds)

- Card payments and cash from ATMs

- Regular subscriptions or bills that pay themselves

- Bank charges

- The money you make from interest, if you have it