Why Customers Switch Banks?

Let's be honest - bank loyalty today is not what it used to be.

A recent survey by First Tech Federal Credit Union found that almost half of Americans considered switching banks over the last two years. Among millennials, this jumps to even higher levels at 59%. The message? People are open to change when their bank doesn't meet their needs.

What causes this shift? Typically, this is about banking customer dissatisfaction. Whether it’s high fees, a slow mobile app, or just poor customer service, it doesn't even take a major complaint for someone to churn.

This picture is not just prevalent in the US: we see this pattern in different parts of the world these days. In the UK, for example, there were more than 1 million reported account switches in 2024, according to the Current Account Switch Service. The top reasons? Better mobile banking, better interest offerings, and - you guessed it - better service.

Below, we've outlined the top reasons consumers switch banks, backed up by real data, and what banks can do for customer retention.

Top Reasons Why Customers Switch Banks

There is no single reason why people switch banks. However, multiple frustrations - some fixable, others institutional - continually appear in studies as the top reasons for changing banks. Here is what the data tells us:

1. Relationship with customer service

Even if they come down to better rates, many customers leave one bank for another due to feeling unheard. Wait times, inflexible processes, and unsympathetic staff all contribute to customer dissatisfaction with their banking experience.

In fact, per the 2024 J.D. Power U.S. Retail Banking Study, poor customer service was cited as the main reason for switching by almost 1 in 3 customers.

Ignoring these signs puts you at risk for more than simply a negative review. It causes long-term client attrition, which is more difficult and costly to address later.

2. Fees

High bank fees have been a frequent issue with traditional banks. From monthly maintenance fees to going negative in your account and being charged overdraft fees, fee frustration has been a big reason many customers choose to leave a bank. In fact, according to a study by The Financial Brand, a digital banking publication, clients chose fees as their most significant reason for considering a switch to another banking provider.

Some customers find resources and strategies to track charges better for higher transparency. For example, learning how to import a bank statement into Excel to break down and understand their spending habits.

3. Slow/Underperforming Online Banking Systems

The banks’ digital platform is as important as the interest rates. When a mobile app is buggy or the banking experience is generally cumbersome, it indicates a lack of innovation.

Today, customers will look for better if a bank can't guarantee a smooth digital experience. For reference, the Current Account Switch Service in the UK reported that online and mobile banking capabilities were among the top reasons for changing banks in 2024.

To appreciate what customers expect from digital platforms today, it is useful to recall what is online banking not merely as a service, but as a part of the overall banking experience.

4. Security and Fraud Concerns

Nothing diminishes trust like a data breach. As fraud and identity theft are on the rise, concern for security has become a top priority. In fact, fraud concerns rank among the top reasons people reconsider their banking relationships.

For added confidence, some users request official documents such as a certified bank statement when proving their financial records in sensitive situations.

5. Major Life Changes

Lastly, sometimes changing banks is not about being displeased. Life happens - sometimes you find yourself in a new location, get married, or change jobs, and you need a different bank closer to your location.

These neutral reasons still pose a loss for the initial bank, but also pose an opportunity to retain a customer by staying relevant and responsive throughout the transition.

6. Lack of Transparency and Communication

One of the other most common reasons why customers switch banks is due to poor communication. Communication issues can include anything from unclear policy changes to vague charges and poor response times. When transparency is absent, customers lose trust and expect to be alerted to these changes, especially about money.

Hidden Costs of Bank Switching

Every time a customer changes banks, the original institution does not just incur a financial loss, but also (potentially) a relationship that could last decades. Churn takes a toll on a bank's operational costs - managing account closures and acquiring new customers is usually five times more expensive than keeping an old customer.

In practice, customer attrition is not often loud. Disengaged customers may use the services and accounts progressively less until the bank no longer recognizes them as customers. This experience is usually called "silent churn." It causes a revenue drop and a debilitating margin on cross-selling opportunities.

In an industry largely dependent on trust, each event reinforces a loss of revenue power. Thus, customer churn directly impacts customer loyalty, profitability, and reputation in the long run.

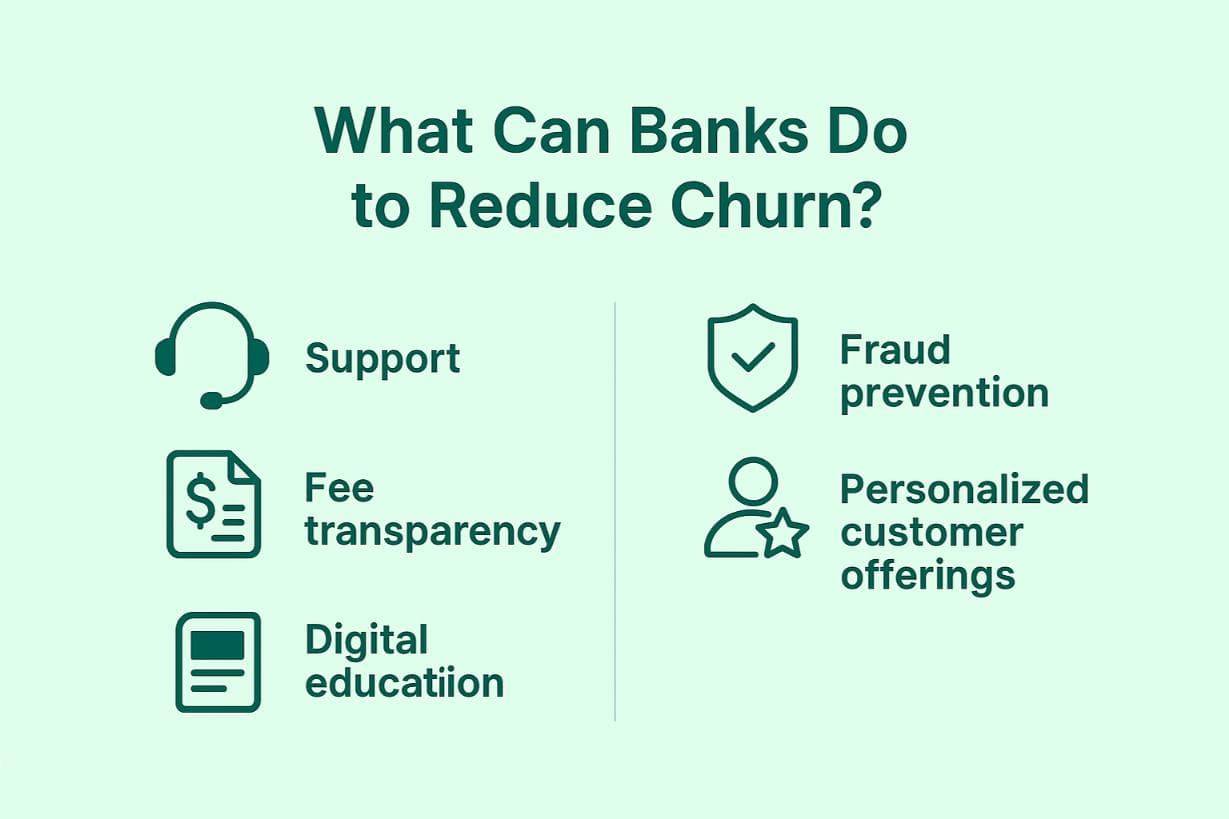

What Can Banks Do to Reduce Churn?

Reducing churn begins with reducing problems that led customers to switch banks in the first place. The most successful banks are not just reactive: they are proactive in building trust and convenience into every customer touchpoint.

- Support - Helps to stop dissatisfaction before it turns into a switch. Customers want fast, friendly, and helpful answers through live chat, phone, email, or face-to-face.

- Fee transparency - Banks should make it easy for users to understand every charge, supported ideally by bank reconciliation audits and dashboards that affordably map and detail spending and fees.

- Digital education - Financial documents like bank and financial statements can feel confusing to new users. Knowing the difference between a bank and financial statement reinforces financial literacy. Teaching users what a bank statement is, how to navigate online banking, and other learning topics safely builds trust.

- Fraud prevention - Investing in real-time alerts, biometric logins, and tamper-proof documents is considered a baseline level of security that customers expect.

- Personalized customer offerings - Banks that personalize their offerings, like custom loan products, intelligent savings suggestions, and support, will thrive the most. Many banks achieve this today by getting customer data and making banking more human and frictionless.

Conclusion

As banking becomes more digital, competitive, and customer-centric, loyalty is no longer guaranteed. Why customers switch banks can be traced from high fees to a lack of service, but it mostly comes down to trust, transparency, and relevance.

Banking is about retaining customers in today's environment, which requires proactive action in the form of educating, communicating, personalizing, and protecting. Tools like online banking and clearer bank statement organization can turn data into loyalty and with tools that support bank statement analysis, users can better understand their finances and avoid surprises

Customers do not leave overnight - they leave when they feel invisible. The banks that will be successful will be those that listen first and innovate next.